Fintech startups are on a quest to revolutionize finance and how people and businesses use and manage their money. By tackling financial problems and needs, Fintech startups are challenging banks and other financial companies through innovation across multiple financial segments and industries.

Financial technology companies, more commonly referred to as Fintech companies, generally focus on disrupting specific business models through financial innovation. Relying upon technology to make business processes simpler, reach wider audiences, or focus on specific customers, they often come into competition against more traditional financial actors who used less efficient methods of conducting business.

And since they evolve in an industry where money is a commodity, Fintech startups that implement successful new business models often reap large benefits very rapidly. Many companies in the list below have therefore raised large amounts of funds to develop promising models in a very short time if they have not already reached a large market and profitable operating margins.

In terms of the actual markets and financial segments being successfully tackled by Fintech companies, we can remark that a number of startups are digital banks, also referred to as “virtual banks” or “neobanks”. The success of this new type of bank seems to prove that the business model of banking without physical branches is gaining traction around the world.

A number of other financial services and industries are being disrupted, including insurance (with insurance technologies startups often referred to as “InsurTech”), payments, stockbroking, transaction processing, mortgage, and more.

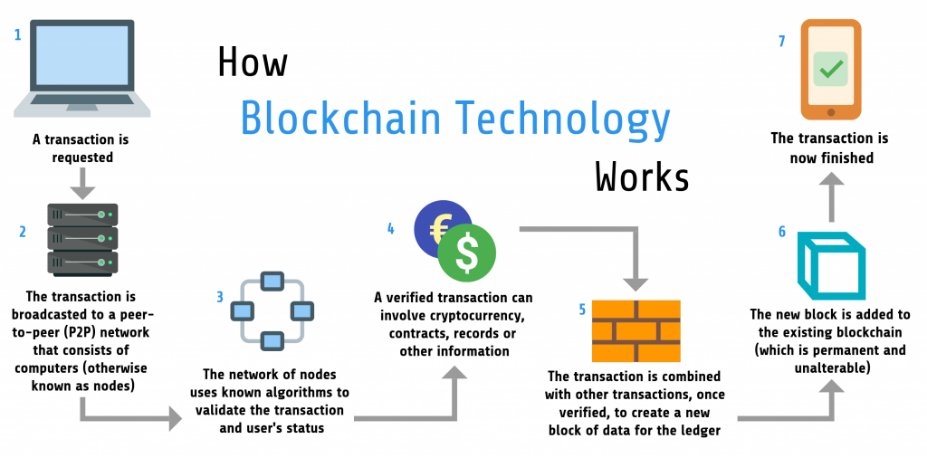

In many cases, the innovation in financial technologies comes from the creation of cryptocurrencies, such as Bitcoin and Ethereum, and even more, the underlying Blockchain technology that allows their decentralization and security. A number of startups use these new technologies to create more efficient ways of doing business by managing decentralized and secured financial ledgers at a fraction of the cost of previous technologies.

Of course, since the American market is much larger and more solvable than other markets, it is no surprise to find American startups making up a large part of the top 30 in the world’s best-funded Fintech startups. However, British startups are also well-represented, thanks to the traditional focus of the British economy on the financial industry and the City of London being one of the world’s top financial centers.

Two Chinese peer-to-peer lending startups also made it to this list, though it is important to notice that only startups are included here. China counts a number of other companies involved in payments and other financial services who are already publicly listed companies or part of some of the countries’ largest tech companies, such as the giant Chinese Fintech company, Ant Financial, which is part of Alibaba Group.

The same goes across the world, as many Fintech startups rapidly reach success, they also rapidly reach the status of multinational, and become publicly listed companies, or get acquired, which in turn makes them unfit to be considered as startups any longer. A number of successful Fintech companies are in this situation, such as Paypal, the pioneer of digital payments, which has become one of the largest US tech companies.

Many of the 30 startups listed here are already famous in their country, having reached a wide base of customers for their products and services. And all of them have thus already reached the “Unicorn” status, that is to say, a valuation of more than a billion dollars. One more proof that Fintech companies tend to be among the most successful and fastest-growing startups around the world.

For the complete list of the world’s unicorn startups, download our 580 Unicorn Startups Excel file which includes valuations, funds raised, known investors, websites link, descriptions, and much more information on each company,

List of the world’s 30 top-funded Fintech startups

Without further ado, here is the list of the top 30 best-funded Fintech startups with details about each company, the total amount of funds received by the company according to Crunchbase, as of October 2020, in US $, British £, Chinese Yuan (with conversion rates of 1,3043 £ per $, and 6,7444 CN¥/$), together with a direct link to the company’s website.

For more information on other world-leading startups, check our series of posts on Top Startups.

Shortcuts to each startup

To facilitate your browsing in this long list, here are quick links to go directly to the details of any of the world’s top 30 Fintech startups. Be sure to also check the Top 10 Fintech startups summary after the list!

30. Marqeta

![]() Industry: Cards Issuing & Processing – Total funding: $528 Million

Industry: Cards Issuing & Processing – Total funding: $528 Million

Marqeta provides a card issuing platform for companies to develop and manage their payments programs. Thanks to its payment processing infrastructure, a set of dedicated tools, and an open API, Marqeta allows companies to create tailored payment innovations, experiences, and commercial uses, complete with their own card systems.

Country: USA – Headquarters: Oakland, CA – Founded: 2010

Website: marqeta.com

29. Coinbase

![]() Industry: Cryptocurrency – Total funding: $547 Million

Industry: Cryptocurrency – Total funding: $547 Million

Coinbase is a digital currency exchange. It allows users, consumers, merchants, and traders to buy and sell digital currencies, including Bitcoin, Ethereum, Litecoin, Tezos, and many others. Coinbase allows users to create bitcoin wallets, enabling them to buy and sell Bitcoins and other digital currencies by connecting them with their bank accounts. Thanks to its API, Coinbase also empowers developers and merchants to build their own applications and accept payments in digital currencies.

Country: USA – Headquarters: San Francisco, CA – Founded: 2012

Website: coinbase.com

28. Dianrong

Industry: P2P Lending – Total funding: $549 Million

Industry: P2P Lending – Total funding: $549 Million

Dianrong is an online marketplace for peer-to-peer lending. It provides financial information and transaction-matching technology and services to individuals and small and medium-sized businesses to easily lend and borrow money. Thanks to its technological infrastructure, Dianrong allows to design and customize a wide array of borrowing and lending products and strategies.

Country: China – Headquarters: Shanghai – Founded: 2013

Website: dianrong.com

27. Atom Bank

Industry: Digital Banking – Total funding: £429 Million

Atom Bank is a mobile bank. It operates exclusively through a mobile application, allowing its customers to benefit from its low-cost model while providing 24/7 online support. Atom Bank also offers a range of personal and business banking products.

Country: UK – Headquarters: Durham – Founded: 2014

Website: atombank.co.uk

26. WeLab

Industry: Digital Banking – Total funding: $581 Million

Industry: Digital Banking – Total funding: $581 Million

WeLab is a full-service digital bank. It allows individuals to open a bank account and manage their money from their mobile phones, together with a number of associated innovative financial services. It notably proposes consumer financing solutions and virtual credit cards for individuals as well as lending solutions for businesses. WeLab operates under different brands in Hong Kong, China, and Indonesia.

Country: Hong Kong – Headquarters: Hong Kong – Founded: 2013

Website: welab.co

25. PolicyBazaar

![]()

Industry: Insurance – Total funding: $627 Million

PolicyBazaar is an insurance aggregator. It allows users to compare health insurance, car insurance, two-wheeler insurance, travel insurance policies based on price, quality, and key benefits together with solutions for financial security and competitive returns.

Country: India – Headquarters: Gurgaon – Founded: 2008

Website: policybazaar.com

24. Carta

Industry: Equity Management – Total funding: $628 Million

Industry: Equity Management – Total funding: $628 Million

Carta is a company specialized in capitalization table management and valuation software. Dedicated to seed-stage to pre-IPO startups and companies, Carta allows them and their founders, employees, and investors to manage equity, be it stocks, stock options, warrants, or derivatives, through a single platform that keep track in real-time of who owns what in the company.

Country: USA – Headquarters: Palo Alto, CA – Founded: 2012

Website: carta.com

23. Next Insurance

Industry: Business Insurance – Total funding: $631 Million

Industry: Business Insurance – Total funding: $631 Million

Next Insurance is an online insurance provider dedicated to small businesses and entrepreneurs. Thanks to its technology, Next Insurance provides attractive prices by eliminating agents and extras, as well as rapid claims management. It offers tailored insurance policies designed for professionals from a wide array of fields including, contractors, construction, fitness, cleaning, beauty, entertainment, education, and many more.

Country: USA – Headquarters: Palo Alto, CA – Founded: 2016

Website: next-insurance.com

22. Tradeshift

![]() Industry: Transactions Processing – Total funding: $661 Million

Industry: Transactions Processing – Total funding: $661 Million

Tradeshift provides a business-to-business platform for supply chain management and payments. It allows companies of all sizes to connect with their suppliers, deliver electronic invoices, manage payments, and acquire products faster. Thanks to Tradeshift, companies can work more easily and effectively across their supply chains and suppliers can better manage their orders, invoices, and cash flows.

Country: USA – Headquarters: San Francisco, CA – Founded: 2009

Website: tradeshift.com

21. Jiedaibao

![]() Industry: P2P Lending – Total funding: CN¥4.5 Billion

Industry: P2P Lending – Total funding: CN¥4.5 Billion

Jiedaibao is a marketplace for peer-to-peer lending. Through its online platform, it allows individuals and companies to lend and borrow money from each other, helping to define interest rates, generating legal contracts, and notifying of repayments and expiration. Thanks to Jiedaibao, borrowers can easily repay, extend, or write off their debts, or engage in mediation and litigation.

Country: China – Headquarters: Beijing – Founded: 2014

Website: jiedaibao.com

20. BGL Group

Industry: Personal Insurance – Total funding: £585 Million

BGL Group is a provider of insurance and household financial products. Tracing its origins to 1992, BGL has revamped its operations through technology, becoming a leading digital distributor of insurance and financial products. It also operates price comparison websites, including comparethemarket.com in the UK and LesFurets.com in France.

Country: UK – Headquarters: Peterborough – Founded: 1992

Website: bglgroup.co.uk

19. Brex

![]() Industry: Corporate Credit Cards – Total funding: $732 Million

Industry: Corporate Credit Cards – Total funding: $732 Million

Brex is a company providing business credit cards and cash management accounts dedicated to technology companies. Thanks to its financial platform, Brex allows companies to manage their finances when they launch, scale, and develop while dissociating the company’s finances from the founders’ personal credit scores and assets.

Country: USA – Headquarters: San Francisco, CA – Founded: 2017

Website: brex.com

18. N26

Industry: Digital Banking – Total funding: $783 Million

N26 a mobile banking platform. It provides current accounts, fixed accounts, and other banking services including cash withdrawal and deposit, international money transfer, investment, and credit. N26 caters to customers in the European Union directly or through its subsidiaries, thanks to a convenient mobile application.

Country: Germany – Headquarters: Berlin – Founded: 2013

Website: n26.com

17. Toast

![]() Industry: Point of Sale Management – Total funding: $902 Million

Industry: Point of Sale Management – Total funding: $902 Million

Toast is a company specialized in point-of-sale and cloud-based restaurant management. With an online platform designed especially for restaurants, Toast provides a complete solution for tableside and online orders and payments, kitchen and staff management, back office management and reporting, and employee payroll management.

Country: USA – Headquarters: Boston, MA – Founded: 2012

Website: pos.toasttab.com

16. Revolut

![]()

Industry: Digital Banking – Total funding: $917 Million

Revolut is a digital bank. It provides a number of banking and financial services through its digital platform, including pre-paid debit cards, currency exchange, and peer-to-peer payments. It allows customers to pay and withdraw money in more than 120 currencies, including 26 directly from its mobile app.

Country: UK – Headquarters: London – Founded: 2015

Website: revolut.com

15. OakNorth

![]()

Industry: Credit Analysis, Digital Banking – Total funding: $1 Billion

OakNorth provides credit analysis and monitoring solutions to credit institutions that lend to small and medium-sized businesses. Relying on machine learning, credit expertise, and big data, OakNorth allows banks and other financial institutions to work more efficiently and reduce risks. OakNorth also is the parent of OakNorth Bank, a leading digital bank in the UK.

Country: UK – Headquarters: London – Founded: 2015

Website: oaknorth.com

14. AvidXchange

![]() Industry: Transactions Processing – Total funding: $1.1 Billion

Industry: Transactions Processing – Total funding: $1.1 Billion

AvidXchange is a company specialized in accounts payable. Specialized in servicing medium-sized businesses, it operates through invoice automation and a payment processing platform, helping them to manage their accounts payable and their relationship with suppliers, as well as paying their expenses.

Country: USA – Headquarters: Charlotte, NC – Founded: 2000

Website: avidxchange.com

13. TransferWise

![]()

Industry: Money Transfer – Total funding: $1.1 Billion

TransferWise is an international money transfer service. It provides customers, individuals, and businesses, an alternative to traditional means of international money transfers at a lower cost thanks to their digital platform and fee structure than undercuts standard bank fees.

Country: UK – Headquarters: London – Founded: 2011

Website: transferwise.com

12. Lendinvest

![]()

Industry: Mortgage – Total funding: $1.3 Billion

LendInvest provides an online marketplace dedicated to property lending and investing. It allows any investor to access various asset classes, underwriting, and pre-funding investments, together with services such as loans for property financing.

Country: UK – Headquarters: London – Founded: 2008

Website: lendinvest.com

11. Prodigy Finance

![]()

Industry: Personal Loans – Total funding: $1.3 Billion

Prodigy Finance is a digital platform specialized in loans to international postgraduate students and refinancing. Granting access to higher education, Prodigy Finance provides loans to students of more than 150 nationalities, funded by a community of alumni, institutional investors, and private investors.

Country: UK – Headquarters: London – Founded: 2007

Website: prodigyfinance.com

10. Figure

![]() Industry: Mortgage – Total funding: $1.4 Billion

Industry: Mortgage – Total funding: $1.4 Billion

Figure provides financial solutions dedicated to homeowners. Relying upon the Blockchain technology, Figure proposes a range of financial products including home equity lines, mortgage refinancing, and investment opportunities. Thanks to its technology, Figure can deliver low-interest rates and customized products, through a simple and intuitive online application.

Country: USA – Headquarters: San Francisco, CA – Founded: 2018

Website: figure.com

9. Nubank

Industry: Digital Banking – Total funding: $1.4 Billion

Nubank is a financial services company providing payment solutions, free-of-charge credit cards, and equity investment to Brazilian customers. Thanks to Nubank, users can access their accounts via their mobile phones, and directly manage their payments and money transfers.

Country: Brazil – Headquarters: São Paulo – Founded: 2013

Website: nubank.com.br

8. Affirm

Industry: Consumer Loans – Total funding: $1.5 Billion

Industry: Consumer Loans – Total funding: $1.5 Billion

Affirm is a company specialized in providing installment loans to consumers at the point of sale. It helps shoppers pay for their purchases across multiple months while increasing conversion and basket size for online merchants. Doing so, Affirm also makes financial services more accessible to consumers.

Country: USA – Headquarters: San Francisco, CA – Founded: 2012

Website: affirm.com

7. Chime

![]() Industry: Digital Banking – Total funding: $1.5 Billion

Industry: Digital Banking – Total funding: $1.5 Billion

Chime is a digital bank that provides financial services without overdraft or maintenance bank fees. Operating through a mobile app or website, Chime proposes a range of spending, savings, and credit-building accounts, together with mobile banking and digital payment solutions for individuals. Since it doesn’t levy service fees, Chime relies on interchange transaction fees to merchants for its business model.

Country: USA – Headquarters: San Francisco, CA – Founded: 2013

Website: chime.com

6. Judo Bank

![]()

Industry: Business Banking – Total funding: $1.5 Billion

Judo Bank is a bank and lender focusing on small and medium-sized companies. Relying upon its online platform and a team of dedicated relationship managers, Judo Bank is dedicated to delivering tailor-make financial solutions, providing business loans that exactly fit the needs of each SME.

Country: Australia – Headquarters: Melbourne – Founded: 2016

Website: judo.bank

5. Avant

![]()

Industry: Personal Loans – Total funding: $1.6 Billion

Avant specializes in providing personal loans. Relying upon big data and machine-learning algorithms, Avant’s financial services marketplace provides a customized and simplified approach to credit, allowing its users to find solutions to consolidate their debts, pay their expenses or vacations.

Country: USA – Headquarters: Chicago, IL – Founded: 2012

Website: avant.com

4. Stripe

Industry: Payments Processing – Total funding: $1.6 Billion

Industry: Payments Processing – Total funding: $1.6 Billion

Stripe is an online payment processing system. It provides a developer platform for businesses to accept online payments and infrastructure for applications such as crowdfunding and marketplaces, fraud prevention, analytics to start, run, and scale their businesses online.

Country: USA – Headquarters: San Francisco, CA – Founded: 2010

Website: stripe.com

3. Klarna

![]() Industry: Payments Processing – Total funding: $2.1 Billion

Industry: Payments Processing – Total funding: $2.1 Billion

Klarna is a platform that provides e-commerce payment solutions. Acting as a bank for merchants and shoppers, Klarna offers a range of payment solutions, including direct payments, pay after delivery options, and installment plans that provide interest-free financing options to shoppers. Originating from Sweden, Klarna has expanded to a number of European countries and the United States.

Country: Sweden – Headquarters: Stockholm – Founded: 2005

Website: klarna.com

2. Robinhood

![]() Industry: Stockbroking – Total funding: $2.2 Billion

Industry: Stockbroking – Total funding: $2.2 Billion

Robinhood is a stock brokering company that offers commission-free investing. Operating through a website and mobile app, Robinhood allows individuals to buy and sell stocks, ETFs, options, and cryptocurrencies without any fee. Also providing cash management accounts, Robinhood’s business model is based on interest earned from customer’s balances and margin lending.

Country: USA – Headquarters: Menlo Park, CA – Founded: 2013

Website: robinhood.com

1. SoFi

![]()

Industry: Personal Loans & Investment – Total funding: $2.5 Billion

SoFi – Social Finance – is a finance company providing a range of lending and wealth management services. Particularly catering to younger professionals, SoFi helps them to save, spend, borrow and invest whether they are looking to buy a home, save money on student loans, grow in their careers, or invest in the future.

Country: USA – Headquarters: San Francisco, CA – Founded: 2011

Website: sofi.com

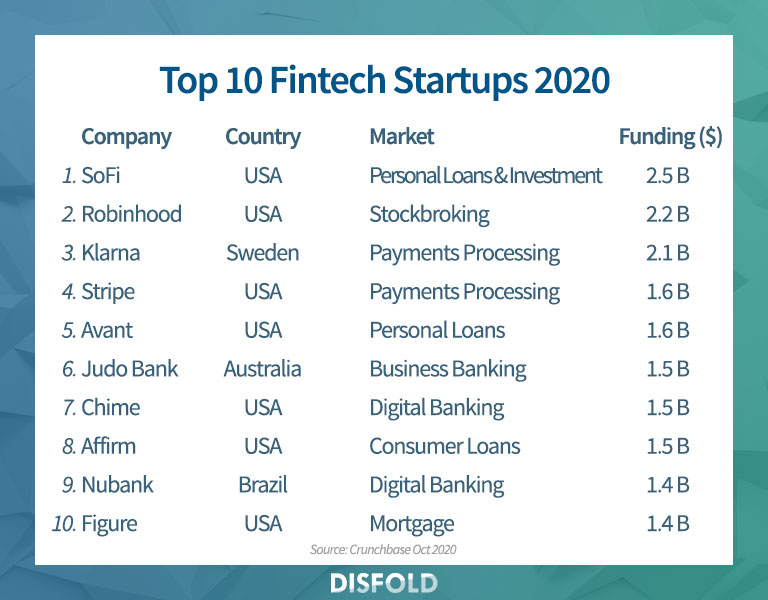

Summary: Top 10 Fintech Startups 2020

To give you a quick overview of the largest Fintech startups in the world in 2020, here is a synthesizing image regrouping the information of the top 10. Note that you can use this image to embed it on your website and other digital properties using the embed code below.

Embed code:

<a href="https://blog.disfold.com/top-fintech-startups/" target="_blank" rel="noopener noreferrer"><img src="https://blog.disfold.com/wp-content/uploads/2020/10/top-10-fintech-startups.jpg" alt="The world's Top 10 Fintech Startups 2020"></a>

Here are the top 30 best-funded Fintech startups in the world. Did we forget any? Did you buy any product or service from them? Which one do you think provides the most useful product or service? Let us know in the comments below!

![Top 1200 UK Companies [FTSE All-Share + FTSE AIM All-Share] – Excel Download](http://store.disfold.com/wp-content/uploads/sites/11/2024/05/top-1200-uk-companies-ftseallshare-aimallshare-small.jpg)

![Top 500 Australian Companies [All Ordinaries] – Excel Download](http://store.disfold.com/wp-content/uploads/sites/11/2021/04/top-500-australian-companies-allordinaries-small.jpg)