Insurance companies are key actors of the American economy, hedging risks and covering the costs of accidents. Present throughout the country and abroad, US insurance companies are involved in life and health insurance, property and casualty insurance, business and commercial insurance, and reinsurance.

The top American insurance companies are important parts of the financial sector and they play a major role in the economy through the management of risks. However, they are engaged in fierce competition against each other for market share in the US and abroad, and face competition from foreign insurers looking to expand their foothold in their domestic market. Other financial companies, such as banks and financial services companies, also challenge them in their insurance and risk management activities in financial markets.

Though they face stiff competition to provide insurance and risk mitigation products and services to individuals, businesses, and institutions, the most important threat for insurers comes from the disruption of their traditional business by insurance tech startups. These new “InsurTech” companies create new ways for people and companies to hedge, manage and anticipate risks and exposure to various hazards, which can impede the activities of traditional insurance companies. And some of them, among the largest US startups, have already grown to become “unicorns”: startups with a valuation above 1 billion dollars.

Nevertheless, insurance companies are still a pillar of the US economy and they will remain in this position for the foreseeable future. The US is such a great business arena for insurers to prosper that they can use their national foothold to expand abroad and conquer new markets. Whether they provide life and health insurance, property and casualty insurance, insurance brokering services, or reinsurance, insurance companies are in the US to stay, and potentially, also to conquer the rest of the world.

For more information on the largest American companies, download our S&P 500 companies Excel file containing the complete list of the 500 largest publicly listed companies in the US, together with extensive business, market, financial, and digital information on each company. For even more data on the largest US companies, download our Excel files on the Russell 1000 companies, Russell 2000 companies, or Russell 3000 companies.

List of the top 20 largest American insurance companies by market capitalization

To give you more perspective on the actors of the American financial sector and insurance industry, details about the twenty largest insurance companies headquartered in the US have been listed hereafter. Each company is detailed with presentations of its industry, activities, market capitalization, a direct link to its website, logo, and stock symbol.

The insurance companies listed hereafter are ranked by market capitalization in United States Dollars, as of effective close on Friday, January 29, 2021. They are defined as belonging to the industries of property and casualty insurance, life and health insurance, multi-line insurance, insurance brokers, and reinsurance.

For more information on other world-leading companies, check our series of posts on Top Companies, and for more information on the country, read our articles on Top Business Resources for the US.

Note that if you are searching for information on these companies to invest in their stocks, make sure you know what you are doing as your investment will be subject to significant risks with the evolution of stock prices. To learn more about investing in the stock market and managing your portfolio, check our post on the best online courses on stock investing and trading.

Shortcuts to each insurance company

To facilitate your browsing in this long list, here are quick links to go directly to the details of any of the top 20 American insurance companies. Be sure to also check the Top 10 US insurance companies’ summary after the list!

20. Globe Life

![]() Industry: Life Insurance

Industry: Life Insurance

Globe Life is a financial services holding company. Providing services through its wholly-owned subsidiaries, Globe Life offers life insurance, annuity, and supplemental health insurance products. It operates primarily in the states of Texas, New York, and Oklahoma.

Website: globelifeinsurance.com – Market Cap.: $9.5 Billion – Stock ticker: GL

19. CNA Insurance

![]() Industry: Property & Casualty Insurance

Industry: Property & Casualty Insurance

CNA Financial Corporation, more simply known as CNA, is a financial company primarily involved in insurance. Tracing its origins to 1897, CNA provides property and casualty insurance products and services for businesses and professionals in the US, Canada, and a number of other countries of Europe and Asia. CNA is owned in majority by Loews Corporation.

Website: cna.com – Market Cap.: $10.4 Billion – Stock ticker: CNA

18. Fidelity National Financial

Industry: Specialty Insurance

Industry: Specialty Insurance

Fidelity National Financial, also known as FNF, is a company operating in title insurance, mortgage, and real estate services, real estate technology and annuities, and life insurance. Offering its services to residential and commercial property owners, FNF also provides technology and transaction services to the real estate and mortgage industries. It also invests in other companies through its FNF Ventures arm.

Website: fnf.com – Market Cap.: $10.7 Billion – Stock ticker: FNF

17. Equitable Holdings

Industry: Diversified Insurance

Industry: Diversified Insurance

Equitable Holdings, Inc. is an insurance company providing life insurance, annuities, and reinsurance, and also engaged in financial services. Tracing its origins to 1859, Equitable Holdings operates in individual and group retirement, and life insurance products through the Equitable brand, and it is also involved in global investment management and research through its AllianceBernstein subsidiary.

Website: equitableholdings.com – Market Cap.: $11 Billion – Stock ticker: EQH

16. Berkley

![]() Industry: Property & Casualty Insurance

Industry: Property & Casualty Insurance

W. R. Berkley Corporation is a property and casualty insurance holding and reinsurance company. Headquartered in Greenwich, Connecticut, and organized in Delaware, W. R. Berkley operates commercial insurance businesses in multiple countries and regions around the world, including the United Kingdom, Continental Europe, South America, Canada, Mexico, Scandinavia, Asia, and Australia. It is also involved in reinsurance businesses in the United States, United Kingdom, Continental Europe, Australia, the Asia-Pacific region, and South Africa.

Website: berkley.com – Market Cap.: $11.1 Billion – Stock ticker: WRB

15. Brown & Brown Insurance

![]() Industry: Insurance Brokers

Industry: Insurance Brokers

Brown & Brown, Inc., better known as Brown & Brown Insurance or B&B, is an insurance brokerage company. It provides risk management, insurance, and reinsurance products and services to businesses, public agencies, professional and trade organizations, families, and individuals. Founded in 1939, and headquartered in Daytona Beach, Florida, Brown & Brown now provides insurance solutions through more than 300 locations throughout the US.

Website: bbinsurance.com – Market Cap.: $12.2 Billion – Stock ticker: BRO

14. Loews

Industry: Property & Casualty Insurance

Industry: Property & Casualty Insurance

Loews Corporation is a conglomerate company with majority-stake holdings in CNA Financial Corporation, Diamond Offshore Drilling, Boardwalk Pipeline Partners, Loews Hotels, and Consolidated Container Company. Primarily engaged in insurance through CNA Financial Corporation and its subsidiaries, it provides property and casualty insurance for businesses and professionals in the U.S., Canada, Europe, and Asia.

Website: loews.com – Market Cap.: $12.4 Billion – Stock ticker: L

13. Erie Insurance

Industry: Insurance Brokers

Industry: Insurance Brokers

Erie Insurance is a diversified insurance company. Founded in 1925, it provides property, car, and life insurance through a network of independent insurance agents operating in 12 northeastern US states. It provides its services through a number of subsidiaries including Erie Insurance Property & Casualty, Flagship City Insurance, Erie Insurance Company, Erie Insurance Company of New York, and Erie Family Life Insurance.

Website: erieinsurance.com – Market Cap.: $12.7 Billion – Stock ticker: ERIE

12. Markel

Industry: Property & Casualty Insurance

Industry: Property & Casualty Insurance

Markel Corporation is a multinational insurance, reinsurance, and investment holding company, founded in 1930. It operates in property and casualty insurance through the Market Specialty, Markel International, and State National brands, reinsurance through Markel Global Reinsurance, insurance-linked securities through Nephila and Lodgepine, and other non-insurance businesses through Markel Ventures.

Website: markel.com – Market Cap.: $13.4 Billion – Stock ticker: MKL

11. Cincinnati Insurance

Industry: Property & Casualty Insurance

Industry: Property & Casualty Insurance

Cincinnati Financial Corporation is an insurance company primarily involved in property and casualty insurance. Founded in 1950, the Cincinnati Financial Corporation operates through its specialized subsidiaries in insurance, indemnity, casualty, life insurance, and underwriting. It is also involved in investments and financial support to other subsidiaries through the CFC Investment Company and asset management services with the CinFin Capital Management Company.

Website: cinfin.com – Market Cap.: $13.5 Billion – Stock ticker: CINF

10. Principal

![]() Industry: Diversified Insurance

Industry: Diversified Insurance

The Principal Financial Group is a financial investment management and insurance company, headquartered in Des Moines, Iowa. It operates across four lines of business: retirement and income solutions, principal global investors, principal international, and US insurance solutions.

Website: principal.com – Market Cap.: $13.5 Billion – Stock ticker: PFG

9. Hartford Insurance

Industry: Diversified Insurance

Industry: Diversified Insurance

The Hartford Financial Services Group, Inc., more simply known as The Hartford, is an investment and insurance company. Founded in 1910 and headquartered in Hartford, Connecticut, the company conducts property and casualty operations, group benefits, and mutual funds, selling its products and services primarily through a network of agents and brokers. It is also involved in auto and home insurance.

Website: thehartford.com – Market Cap.: $17.2 Billion – Stock ticker: HIG

8. Gallagher

![]() Industry: Insurance Brokers

Industry: Insurance Brokers

Arthur J. Gallagher & Co., often abbreviated AJG, is a global insurance brokerage and risk management services company. Founded in 1927 and headquartered in Rolling Meadows, Illinois, AJG has become one of the largest insurance brokers in the world, operating in the Americas, Europe, Asia, and Oceania through local insurance brokering subsidiaries.

Website: ajg.com – Market Cap.: $22.2 Billion – Stock ticker: AJG

7. Prudential Financial

![]() Industry: Life Insurance

Industry: Life Insurance

Prudential Financial, Inc. is engaged in insurance, investment management, and other financial products and services to individual and institutional customers through its subsidiaries. It notably provides life insurance, annuities, mutual funds, pension- and retirement-related investments, administration and asset management, securities brokerage services. Prudential operates in the United States, Asia, Europe, and Latin America

Website: prudential.com – Market Cap.: $31 Billion – Stock ticker: PRU

6. Aflac

![]() Industry: Life Insurance

Industry: Life Insurance

Aflac Inc. is an insurance company, especially involved in supplemental insurance. Founded in 1955 and headquartered in Columbus, Georgia, Aflac provides insurance and payroll deduction insurance coverage for accidents or illnesses. Aflac operates with licensed sales associates in the United States and sales agencies in Japan.

Website: aflac.com – Market Cap.: $31.7 Billion – Stock ticker: AFL

5. Allstate

![]() Industry: Property & Casualty Insurance

Industry: Property & Casualty Insurance

The Allstate Corporation is an insurance company headquartered in Northfield Township, Illinois. Tracing its origins to 1931, Allstate Corporation has grown to become the largest publicly-traded property-casualty insurance in the US, offering individual auto and property insurance together with business and commercial insurance as well as an array of associated insurance products. Allstate operates 19 companies in the United States, United Kingdom, Canada, and India.

Website: allstate.com – Market Cap.: $32.6 Billion – Stock ticker: ALL

4. Travelers

![]() Industry: Property & Casualty Insurance

Industry: Property & Casualty Insurance

The Travelers Companies, Inc., better known as Travelers, is an insurance company headquartered in New York City, particularly involved in commercial property-casualty insurance. One of the largest insurers in the US, Travelers operates in personal insurance, business insurance, and bonds. It has expanded in the United Kingdom, Ireland, Singapore, China, Canada, and Brazil.

Website: travelers.com – Market Cap.: $34.4 Billion – Stock ticker: TRV

3. MetLife

![]() Industry: Life Insurance

Industry: Life Insurance

MetLife, Inc. is among the largest global providers of insurance, annuities, and employee benefit programs through its subsidiary Metropolitan Life Insurance Company. Founded in 1968, MetLife operates in home, car, and life insurance, commercial mortgages and securities backed by commercial mortgages, and sovereign debt. It conducts business throughout the United States, Japan, Latin America, Asia Pacific region, Europe, and the Middle East.

Website: metlife.com – Market Cap.: $43.3 Billion – Stock ticker: MET

2. Progressive

![]() Industry: Property & Casualty Insurance

Industry: Property & Casualty Insurance

The Progressive Corporation, more simply known as Progressive, is an insurance company, especially involved in car insurance in America. Founded in 1937 and headquartered in Mayfield Village, Ohio, Progressive offers insurance for motorcycles, boats, RVs, and commercial vehicles, as well as home insurance. It has expanded its offer of car insurance in Australia.

Website: progressive.com – Market Cap.: $51 Billion – Stock ticker: PGR

1. Marsh & McLennan

![]() Industry: Insurance Brokers

Industry: Insurance Brokers

Marsh & McLennan Companies, Inc. is a global professional services company operating in insurance brokerage, risk management, reinsurance services, talent management, investment advisory, and management consulting. Tracing its origins to 1905 and headquartered in New York City, Marsh & McLennan operates in insurance through its subsidiaries, Marsh, Guy Carpenter, and Jardine Lloyd Thompson, and in consulting with Mercer and Oliver Wyman Group.

Website: mmc.com – Market Cap.: $55.7 Billion – Stock ticker: MMC

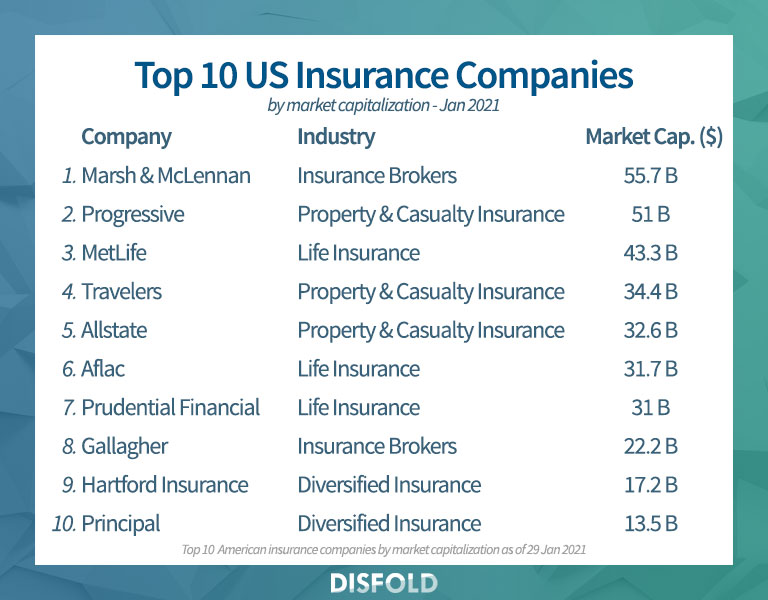

Summary: Top 10 US Insurance Companies 2021

To give you a quick overview of the largest American insurance companies in 2021, here is a synthesizing image regrouping the information of the top 10. Note that you can use this image to embed it on your website and other digital properties using the embed code below.

Embed code:

<a href="https://blog.disfold.com/top-us-insurance-companies/" target="_blank" rel="noopener noreferrer"><img src="https://blog.disfold.com/wp-content/uploads/2021/03/top-10-us-insurance.jpg" alt="Top 10 US Insurance Companies 2021"></a>

Here are the 20 largest American insurance companies. Do you think they are worth their market capitalization? Do they provide a valuable and convenient service? Do they have too much economic power… and maybe political power too?

Leave your comments below!

![Top 1200 UK Companies [FTSE All-Share + FTSE AIM All-Share] – Excel Download](http://store.disfold.com/wp-content/uploads/sites/11/2024/05/top-1200-uk-companies-ftseallshare-aimallshare-small.jpg)

![Top 500 Australian Companies [All Ordinaries] – Excel Download](http://store.disfold.com/wp-content/uploads/sites/11/2021/04/top-500-australian-companies-allordinaries-small.jpg)

Thanks, for providing a list of insurance companies. Really you give good information. once again thanks a lot for the information.

Should AFLAC use the same advertising campaign in Japan as it does in the US?