Energy companies are a critical part of the American economy, powering individuals and businesses for the comfort and technologies they use on a day-to-day basis. A vital but often dirty power supply, the entire energy sector is engaged in a transition towards cleaner and more renewable sources and uses of power.

The largest energy companies of the United States primarily operate in two main areas: Oil & Gas and Utilities. The Global Industry Classification Standard, which intends to define companies according to their activities, defines Oil & Gas companies as belonging to the “Energy” sector, while electricity producers and utility distributors are categorized in the “Utilities” sector.

And companies involved in energy are often specialized either in the exploration, extraction (upstream), transportation, refining (midstream), and marketing and distribution (downstream) of hydrocarbons, or the generation of electricity in power plants, and the transmission and delivery of electricity.

However, many “utilities” companies are also engaged in the distribution of natural gas for heating and domestic power generation, and the very largest companies are involved in multiple activities of both sectors, and even further into associated engineering or industrial activities. So the companies included hereafter do reflect this separation, even though many of them often have a foot on the other side of this demarcation.

The Oil & Gas segment is quite dominated by the two largest companies in the list, Chevron (#2) and ExxonMobil (#1) which are often considered as part of the major global petroleum companies. The other companies primarily involved Oil & Gas being significantly smaller than their two arch-rivals.

The Utilities segment seems to be more evenly represented. Even though NextEra Energy (#3) is quite larger than its followers, the difference in market capitalization is not as obvious. In the Utilities sector, since power generation and distribution network investments are very expensive, companies tend to have a distribution network spanning a few states. Companies are not competing for the whole US market, but rather focusing on local distribution areas. They also often operate under tight price regulation, which also limits competition and expansion.

But both segments are under pressure to become cleaner and move away from fossil fuels to more renewable sources. The development of solar and wind power generation is accelerating, and many utility companies are pledging a larger portion of their investments in that direction. For Oil & Gas companies, the push for green energy turns the favors towards natural gas which has less nocive emissions, and new investments in technologies to reduce emissions and collect carbon dioxide.

For more information on the largest American companies, download our S&P 500 companies Excel file containing the complete list of the 500 largest publicly listed companies in the US, together with extensive business, market, financial, and digital information on each company. For even more data on the largest US companies, download our Excel files on the Russell 1000 companies, Russell 2000 companies, or Russell 3000 companies.

Check our data platform for the latest ranking of US energy companies.

List of the top 30 largest American energy companies by market capitalization

To give you more perspective on what companies are in the energy field in the US, details about the thirty largest public companies that produce and deliver power in America have been listed hereafter. Each company is detailed with presentations of its sector, sub-industry, activities, market capitalization, a direct link to its website, logo, and stock symbol.

The energy companies listed hereafter are ranked by market capitalization in United States Dollars, as of effective close on Friday, January 29, 2021. They are defined as belonging to the specific sectors of Energy, with companies primarily involved in the Oil & Gas industries, or Utilities, for companies primarily involved in electricity generation and electricity and natural gas distribution.

For more information on other world-leading companies, check our series of posts on Top Companies, and for more information on the country, read our articles on Top Business Resources for the US.

Note that if you are searching for information on these companies to invest in their stocks, make sure you know what you are doing as your investment will be subject to significant risks with the evolution of stock prices. To learn more about investing in the stock market and managing your portfolio, check our post on the best online courses on stock investing and trading.

Shortcuts to each energy company

To facilitate your browsing in this long list, here are quick links to go directly to the details of any of the top 30 American energy companies. Be sure to also check the Top 10 US energy companies’ summary after the list!

30. Cheniere Energy

![]()

Industry: Oil & Gas Midstream

Cheniere Energy Partners, L.P. is a full-service liquefied natural gas (LNG) company. Operating and managing LNG facilities in Louisiana and Texas, Cheniere purchases natural gas, processing it to transform it in LNG that it then delivers to corporate customers or directly sells on the LNG market.

Website: cheniere.com – Market Cap.: $18.9 Billion – Stock ticker: CQP

29. Entergy

Industry: Diversified Utilities

Industry: Diversified Utilities

Entergy Corporation is an energy company primarily operating in electric power production and retail distribution. It owns and operates nuclear, natural gas, coal, oil, hydroelectric, and solar power plants with about 30,000 megawatts of electric generating capacity, and delivers electricity to 2.9 million customers in Arkansas, Louisiana, Mississippi, and Texas.

Website: entergy.com – Market Cap.: $19.1 Billion – Stock ticker: ETR

28. PPL

Industry: Electric Utilities

Industry: Electric Utilities

The PPL Corporation is a utility company primarily engaged in the production and distribution of electricity. Tracing its origins to the creation of Pennsylvania Power and Light in 1920, PPL now delivers electricity to more than 10 million customers in Kentucky, Pennsylvania, and the U.K. Operating through seven regulated subsidiaries, PPL produces power from coal, oil, or natural gas and it is also involved in natural gas distribution and solar energy.

Website: pplweb.com – Market Cap.: $21.3 Billion – Stock ticker: PPL

27. Edison International

![]() Industry: Electric Utilities

Industry: Electric Utilities

Edison International is an electric power producer and distributor. Tracing its origins to 1886, it now primarily operates through two subsidiaries: Southern California Edison which produces energy, including renewable energy, and distributes it to about 15 million in Southern California, and Edison Energy which provides energy advisory and services to large energy users.

Website: edison.com – Market Cap.: $22 Billion – Stock ticker: EIX

26. PG&E Corporation

![]() Industry: Electric Utilities

Industry: Electric Utilities

The Pacific Gas and Electric Company, more simply known as PG&E, is an investor-owned utility company involved in power generation and distribution of natural gas and electricity. Generating power through hydroelectric, nuclear, combustion, and solar plants, PG&E also provides energy to more than 5.2 million households in northern California.

Website: pgecorp.com – Market Cap.: $22.7 Billion – Stock ticker: PCG

25. DTE Energy

Industry: Electric Utilities

Industry: Electric Utilities

DTE Energy, which stands for the former name Detroit Edison, is involved in the production and distribution of energy. It notably provides electric utilities to 2.2 million customers and natural gas utilities to 1.3 million customers in Michigan. DTE also operates in non-utility energy businesses through subsidiaries in gas pipelines in the U.S. and Canada, gas storage, industrial projects, biomass renewable energy production, and energy marketing and trading.

Website: newlook.dteenergy.com – Market Cap.: $23 Billion – Stock ticker: DTE

24. Valero

Industry: Oil & Gas Refining & Marketing

Industry: Oil & Gas Refining & Marketing

Valero Energy Corporation is a manufacturer and marketer of transportation fuels and petrochemical products. It operates 15 petroleum refineries in the United States, Canada, and the United Kingdom, producing about 3.2 million barrels per day, and 14 ethanol plants throughout the U.S., producing 1.7 billion gallons per year and sells its products wholesale throughout the Americas, the U.K. and Ireland. Through its participation in Diamond Green Diesel, Valero is also involved in the operation of the largest biomass-based diesel plant.

Website: valero.com – Market Cap.: $23 Billion – Stock ticker: VLO

23. Consolidated Edison

![]() Industry: Electric Utilities

Industry: Electric Utilities

Consolidated Edison, Inc., more simply known as Con Edison, is an energy delivery company. Established in 1823, it provides electric, gas, and steam energy services to more than 10 million customers in New York City, Westchester County, southeastern New York, and northern New Jersey. The electricity delivered is primarily acquired from third-parties, with some renewable energy production capacity.

Website: conedison.com – Market Cap.: $23.7 Billion – Stock ticker: ED

22. MPLX

Industry: Oil & Gas Midstream

Industry: Oil & Gas Midstream

MPLX LP is a diversified hydrocarbon midstream company. It operates in gathering, processing, transportation, and providing services for natural gas, natural gas liquids, crude oil and refined petroleum products, and fuels. MPLX is majority-owned by Marathon Petroleum.

Website: mplx.com – Market Cap.: $24 Billion – Stock ticker: MPLX

21. Williams

Industry: Oil & Gas Midstream

Industry: Oil & Gas Midstream

The Williams Companies, Inc., is a company primarily involved in natural gas processing and transportation tracing its origins to 1908. It operates interstate natural gas and gas liquids pipelines between supply basins and consuming areas in the central and northwestern states, and the Gulf of Mexico and northeastern states, together with offshore platforms, gas plants, fractionators, and storage facilities.

Website: co.williams.com – Market Cap.: $25.8 Billion – Stock ticker: WMB

20. Pioneer Natural Resources

![]() Industry: Oil & Gas E&P

Industry: Oil & Gas E&P

Pioneer Natural Resources Company, also more simply known as Pioneer, is a company engaged in hydrocarbon exploration and production. It is especially involved in oil extraction in the Permian Basin in Western Texas, together with natural gas liquids and natural gas. Pioneer also operates in associated businesses, including oil and gas technologies, royalties, and integrated services in well services and water management.

Website: pxd.com – Market Cap.: $26.1 Billion – Stock ticker: PXD

19. WEC Energy Group

![]() Industry: Electric Utilities

Industry: Electric Utilities

WEC Energy Group Inc. is an electricity and natural gas utilities company. It operates in electric power generation and the distribution of electricity and natural gas through a number of subsidiary companies. Tracing its origins to 1896, WEC Energy Group produces more than 7,100 megawatts of electricity and provides services to 4.5 million customers in Wisconsin, Illinois, Michigan, and Minnesota.

Website: wecenergygroup.com – Market Cap.: $28 Billion – Stock ticker: WEC

18. Marathon Petroleum

Industry: Oil & Gas Refining & Marketing

Industry: Oil & Gas Refining & Marketing

Marathon Petroleum Corporation is a petroleum refining company. It operates in the refining, marketing, and transportation of petroleum products, petrochemicals, and gasoline marketed notably in Marathon branded outlets, as well as in its retail subsidiary Speedway LLC. Marathon Oil operates 16 refineries throughout the United States with more than 3 million barrels of crude oil capacity per day.

Website: marathonpetroleum.com – Market Cap.: $28.1 Billion – Stock ticker: MPC

17. PSEG

![]() Industry: Diversified Utilities

Industry: Diversified Utilities

PSEG, which stands for the Public Service Enterprise Group, is a diversified energy utility company formed in 1903. Through its subsidiaries, PSEG primarily operates nuclear and natural gas power plans and solar energy facilities, providing electricity to 2.3 million customers and gas to 1.9 million customers in New Jersey, as well as 1.1 million customers in Long Island.

Website: pseg.com – Market Cap.: $28.5 Billion – Stock ticker: PEG

16. Phillips 66

Industry: Oil & Gas Refining & Marketing

Industry: Oil & Gas Refining & Marketing

The Phillips 66 Company is a petroleum refining company. Tracing its origins to 1917, Philips 66 now operates 13 oil refineries with a net crude oil capacity of 2.2 million barrels per day, producing natural gas, petrochemicals, aviation fuels, motor fuels, and lubricants. It also owns the Conoco, Phillips 66, and 76 stations retail outlets in the U.S. and jet filling stations in Europe, as well as pipeline, and a share in natural gas and chemical companies. It was separated from ConocoPhilips in 2012.

Website: phillips66.com – Market Cap.: $29.6 Billion – Stock ticker: PSX

15. EOG Resources

![]() Industry: Oil & Gas E&P

Industry: Oil & Gas E&P

EOG Resources, Inc. is a hydrocarbon exploration and extraction company. It operates in the production of petroleum, natural gas liquids, and natural gas in the United States, Canada, Trinidad and Tobago, and China, with more than 800,000 barrels of oil equivalent per day. EOG Resources has more than 3.3 billion barrels of oil equivalent of estimated proved reserves, predominantly located in the U.S.

Website: eogresources.com – Market Cap.: $29.7 Billion – Stock ticker: EOG

14. Eversource

![]() Industry: Electric Utilities

Industry: Electric Utilities

Eversource Energy is a utility company. It transmits and delivers electricity and natural gas to approximately 3.7 million customers in Connecticut, Massachusetts, and New Hampshire. Eversource also operates in water utility through its subsidiary Aquarion Water Company, acquired in 2017.

Website: eversource.com – Market Cap.: $30 Billion – Stock ticker: ES

13. Kinder Morgan

![]() Industry: Oil & Gas Midstream

Industry: Oil & Gas Midstream

Kinder Morgan, Inc. is an energy company specialized in oil and gas pipelines and terminals. It transports natural gas, refined petroleum products, crude oil, carbon dioxide, and more through approximately 83,000 miles of pipelines across the U.S. and Canada, and handles a variety of raw and refined products in its 147 terminals, including gasoline, jet fuel, ethanol, coal, petroleum coke, and steel.

Website: kindermorgan.com – Market Cap.: $31.9 Billion – Stock ticker: KMI

12. Xcel Energy

![]() Industry: Electric Utilities

Industry: Electric Utilities

Xcel Energy Inc. is an electric utility company. Through its subsidiaries, Xcel Energy operates coal, hydro, nuclear, and biomass power plants, serving more than 3.3 million electricity customers, and delivers natural gas to 1.8 customers in Minnesota, Michigan, Wisconsin, North Dakota, South Dakota, Colorado, Texas, and New Mexico.

Website: xcelenergy.com – Market Cap.: $34.4 Billion – Stock ticker: XEL

11. Sempra Energy

![]() Industry: Diversified Utilities

Industry: Diversified Utilities

Sempra Energy is an electric and natural gas utility company. It develops and operates electric and natural gas infrastructure, electric distribution lines, liquefied natural gas facilities, and distribution networks. Through its subsidiaries, Sempra Energy serves more than 35 million electric and natural gas customers in California, Texas, and Mexico.

Website: sempra.com – Market Cap.: $35.7 Billion – Stock ticker: SRE

10. American Electric Power

Industry: Electric Utilities

Industry: Electric Utilities

American Electric Power, also known by the acronym AEP, is an electric utility company. Tracing its origins to 1906, AEP now operates in power generation primarily with coal-fueled power plants, but also with natural gas and nuclear plants, and wind, hydro, pumped storage, and other sources. It is also involved in power transmission and delivery through local subsidiaries in Ohio, Texas, Tennessee, West Virginia, Indiana, Michigan, Kentucky, Oklahoma, Arkansas, and Louisiana.

Website: aep.com – Market Cap.: $40.2 Billion – Stock ticker: AEP

9. Exelon

![]() Industry: Diversified Utilities

Industry: Diversified Utilities

Exelon Corporation is an electric utility company, engaged in the production and distribution of electricity. The largest operator of nuclear power plants in the U.S., Exelon also generates electric power through fossil fuel plants, hydroelectric, solar plants, and wind turbines. It delivers electricity to more than 10 million customers in Illinois, Pennsylvania, Maryland, Delaware, New Jersey, and Washington, DC through local subsidiaries.

Website: exeloncorp.com – Market Cap.: $40.5 Billion – Stock ticker: EXC

8. Enterprise Products

![]() Industry: Oil & Gas Midstream

Industry: Oil & Gas Midstream

Enterprise Products Partners L.P. is a natural gas and crude oil transportation company. A key player in the midstream segment, Enterprise Products is involved in a number of activities including pipelines, storage, drilling platforms, fractioning and processing for natural gas, natural gas liquids, crude oil, refined products and petrochemicals.

Website: enterpriseproducts.com – Market Cap.: $44.2 Billion – Stock ticker: EPD

7. ConocoPhillips

![]() Industry: Oil & Gas E&P

Industry: Oil & Gas E&P

ConocoPhillips is a company specialized in oil and gas exploration and production. With roots dating back to 1885, ConocoPhilips is now a global leader in exploration, production, and transport to market with a geographical segmented presence in Alaska, the 48 U.S. states (Lower 48), Latin America, Canada, Europe, Asia Pacific, the Middle East, and other locations. The downstream activities of ConocoPhillips were separated as Phillips 66 in 2012.

Website: conocophillips.com – Market Cap.: $54.2 Billion – Stock ticker: COP

6. Dominion Energy

Industry: Diversified Utilities

Industry: Diversified Utilities

Dominion Energy, Inc., also more simply known as Dominion, is an electric and natural gas utility company. It operates in power generation with a number of nuclear, natural gas, coal-fired and hydroelectric plants, and solar farms, transmission and delivery of natural gas in Utah, Wyoming, and Idaho, and electricity to 2.6 million customers in Virginia and North Carolina.

Website: dominionenergy.com – Market Cap.: $59.5 Billion – Stock ticker: D

5. Southern Company

![]() Industry: Electric Utilities

Industry: Electric Utilities

Southern Company is an electric utility company. Through its subsidiaries, it serves 9 million natural gas and electric utility customers in Alabama, Georgia, Illinois, Mississippi, Tennessee, and Virginia. With origins dating back to 1924, it now operates multiple coal-fired, nuclear, and natural gas power plants as well as some renewable energy sources.

Website: southerncompany.com – Market Cap.: $62.2 Billion – Stock ticker: SO

4. Duke Energy

Industry: Electric Utilities

Industry: Electric Utilities

Duke Energy Corporation is an electric and natural gas utility company. Tracing its origins to 1900, Duke Energy now manages a number of nuclear, coal-fired, hydroelectric, oil and gas-fired plants, solar and wind farms, with more than 51,000 megawatts of capacity, and distributes electricity to 7.7 million customers in Ohio, Kentucky, Indiana, North and South Carolina, Florida, Tennessee, and Puerto Rico. It also serves more than 1.6 million natural gas customers in Ohio, Kentucky, Tennessee, and the Carolinas.

Website: duke-energy.com – Market Cap.: $69.2 Billion – Stock ticker: DUK

3. NextEra Energy

Industry: Electric Utilities

Industry: Electric Utilities

NextEra Energy, Inc. is an electric utility company particularly involved in renewable energies. Tracing its history to 1925, NextEra Energy is the world’s largest utility company, operating the world’s largest generator of wind and solar renewable energy, together with natural gas, nuclear energy, and oil power plants through its subsidiaries. It distributes power to 5 million customers throughout the United States and Canada.

Website: nexteraenergy.com – Market Cap.: $158.4 Billion – Stock ticker: NEE

2. Chevron

Industry: Oil & Gas Integrated

Industry: Oil & Gas Integrated

Chevron Corporation is a multinational energy company involved in every aspect of the oil, natural gas, and geothermal energy industries in more than 180 countries. Chevron operates in hydrocarbon exploration and production, hydrocarbon refining, marketing and transport, chemicals manufacturing and sales, and power generation.

Website: chevron.com – Market Cap.: $164 Billion – Stock ticker: CVX

1. ExxonMobil

![]() Industry: Oil & Gas Integrated

Industry: Oil & Gas Integrated

Exxon Mobil Corporation, more commonly known as ExxonMobil, is the world’s largest energy company, operating in the exploration, production, transportation, and sale of crude oil and natural gas. ExxonMobil is also engaged in the manufacturing, transportation, and sale of petroleum products, markets commodity petrochemicals, and a range of specialty products.

Website: corporate.exxonmobil.com – Market Cap.: $189.6 Billion – Stock ticker: XOM

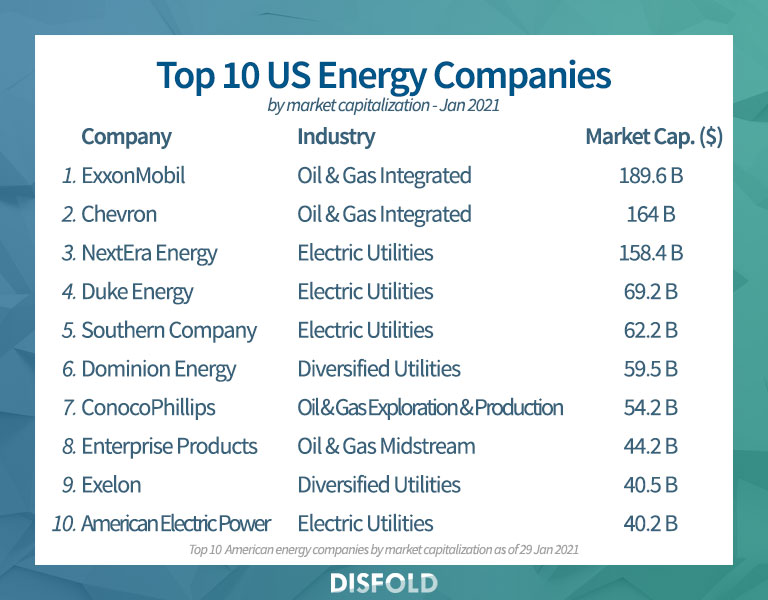

Summary: Top 10 US Energy Companies 2021

To give you a quick overview of the largest American energy companies in 2021, here is a synthesizing image regrouping the information of the top 10. Note that you can use this image to embed it on your website and other digital properties using the embed code below.

Embed code:

<a href="https://blog.disfold.com/top-us-energy-companies/" target="_blank" rel="noopener noreferrer"><img src="https://blog.disfold.com/wp-content/uploads/2021/05/top-10-us-energy.jpg" alt="Top 10 US Energy Companies 2021"></a>

Here are the 30 largest American energy companies. Do you think they are worth their market capitalization? Do they provide a valuable and convenient service? Do they have too much economic power… and maybe political power too?

Leave your comments below!

![Top 1200 UK Companies [FTSE All-Share + FTSE AIM All-Share] – Excel Download](http://store.disfold.com/wp-content/uploads/sites/11/2024/05/top-1200-uk-companies-ftseallshare-aimallshare-small.jpg)

![Top 500 Australian Companies [All Ordinaries] – Excel Download](http://store.disfold.com/wp-content/uploads/sites/11/2021/04/top-500-australian-companies-allordinaries-small.jpg)