One of the world’s largest companies, Amazon is the uncontested global leader of e-commerce. Thanks to its dedication to customers, large choice of products and services, and global presence, Amazon earns billions of dollars, and it intends to keep on expanding its domination on online shopping, and beyond.

Founded in 1994 in Bellevue (next to Seattle), WA, the key to Amazon’s success has been its relentless struggle to become “Earth’s most customer-centric company” according to its own motto. Besides growing over the years thanks to its customers’ satisfaction, Amazon has also become a platform serving an entire eco-system of sellers, developers, enterprises, and content creators who gravitate around the company’s e-commerce activities and make use of its online marketplace and physical stores.

But Amazon is not just a retail company anymore. It is firmly engaged in the broader technology sector, particularly since the launch of Amazon Web Services – AWS – in 2004 which has now grown into the world’s leader in on-demand cloud computing, and a big contributor to the company’s revenues and profits. That’s why Amazon now separates its activities into three segments: North America, International, and AWS.

Interested in data on top US companies?

Save tens of hours in 2 minutes with some of our best-selling Excel files:

Summary

• Revenues: how Amazon earns its billions

- Key products and services in Amazon stores

- Amazon’s own electronic products

- Amazon subscription services

- Amazon diversifying its sources of revenue

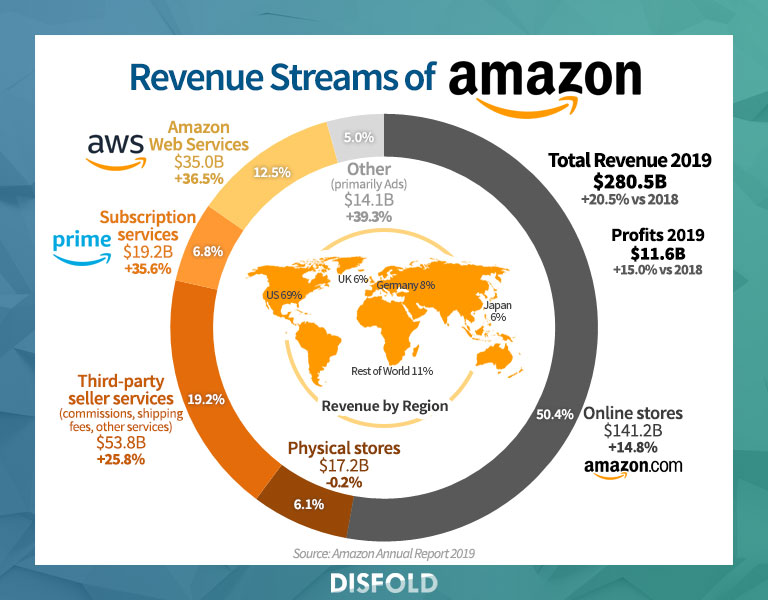

- Graph: Revenue Streams of Amazon

- Amazon’s growing operating costs

- The colossal profits of Amazon

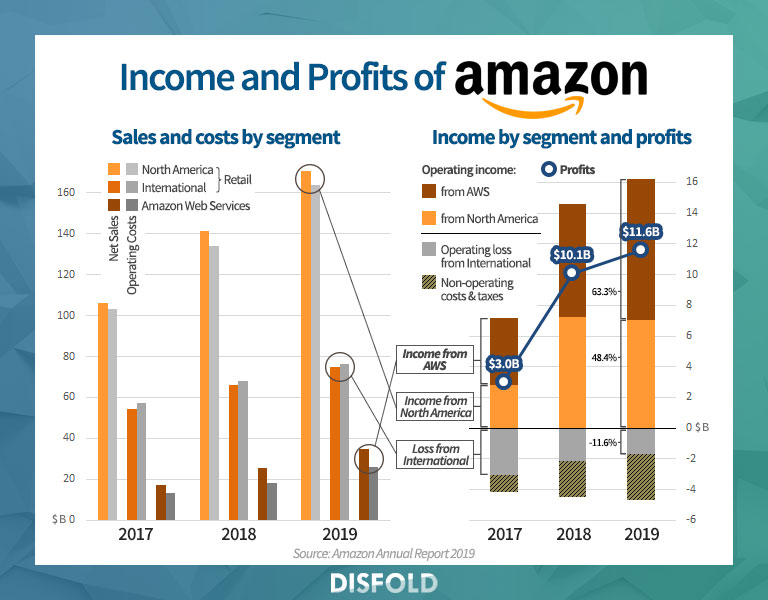

- Graph: Income and Profits of Amazon

Revenues: how Amazon earns its billions

The division between Amazon’s segments roughly corresponds to the historic activities of e-commerce, to which were later added physical retail activities for both regional segments, North America and International, with the third segment for Amazon Web Services and its activities. Amazon’s 2019 annual report presents the three segments as follows.

The North America segment primarily consists of amounts earned from retail sales of consumer products (including from [third-party] sellers) and subscriptions through North America-focused online and physical stores. This segment includes export sales from these online stores.

The International segment primarily consists of amounts earned from retail sales of consumer products (including from [third-party] sellers) and subscriptions through internationally-focused online stores. This segment includes export sales from these internationally-focused online stores (including export sales from these online stores to customers in the U.S., Mexico, and Canada), but excludes export sales from our North America-focused online stores.

The AWS segment consists of amounts earned from global sales of compute, storage, database, and other service offerings for start-ups, enterprises, government agencies, and academic institutions.”

Key products and services in Amazon stores

When it comes to the actual products available in the online and physical stores, Amazon has one of the largest range available online, going from its initial books to electronic products, further into clothing and department stores categories and digital media streaming, all the way to fresh foods and drinks, when the local legislation allows it. Amazon distributes these products and services either directly through its own supply chain and Amazon brand or as a marketplace and logistics platform for third-party sellers, with home delivery services or in-store purchases.

Some parts of the catalog on offer require specific operations and marketing tactics. Certain key products and services are therefore highlighted here to understand some of Amazon’s most important interests when it comes to retail activities, how it aims at strengthening its hold on e-commerce in the United States and many other countries, how it plans to grow its revenues and margins, or how it intends to expand to other industries and challenge their current leaders.

Amazon’s own electronic products

![]() Kindle is a series of electronic devices enabling users to read e-books, newspapers, magazines, and other digital media. It allows users to browse, buy, and download these products from the Kindle Store, thus also stimulating the sales from its digital media shop as well as self-publishing services.

Kindle is a series of electronic devices enabling users to read e-books, newspapers, magazines, and other digital media. It allows users to browse, buy, and download these products from the Kindle Store, thus also stimulating the sales from its digital media shop as well as self-publishing services.

![]() Echo is a brand of smart speakers which relies upon the Alexa virtual assistant AI technology. It allows users to control several interlinked smart devices through voice interaction and launch a number of commands, including music and other media playback or streaming, making to-do lists, setting alarms, and providing real-time information such as news. Echo notably competes against Google Home smart speakers and associated products.

Echo is a brand of smart speakers which relies upon the Alexa virtual assistant AI technology. It allows users to control several interlinked smart devices through voice interaction and launch a number of commands, including music and other media playback or streaming, making to-do lists, setting alarms, and providing real-time information such as news. Echo notably competes against Google Home smart speakers and associated products.

Other Amazon products include a range of other devices relying upon Alexa vocal assistant, such as smart display screens, TV remotes, earbuds, eyeglasses, rings, and other wearables, as well as Ring video doorbells and other smart home products. (See below for more on this acquired company.)

Other Amazon products include a range of other devices relying upon Alexa vocal assistant, such as smart display screens, TV remotes, earbuds, eyeglasses, rings, and other wearables, as well as Ring video doorbells and other smart home products. (See below for more on this acquired company.)

Amazon subscription services

Prime is a paid subscription service granting access to premium services on Amazon’s stores, including free one or two-day delivery, streaming music and video (Amazon Prime Video), and other benefits. Amazon reports more than 150 million subscribers worldwide to Amazon Prime as of January 2020.

Prime is a paid subscription service granting access to premium services on Amazon’s stores, including free one or two-day delivery, streaming music and video (Amazon Prime Video), and other benefits. Amazon reports more than 150 million subscribers worldwide to Amazon Prime as of January 2020.

![]() Prime Video is a video-on-demand service. Competing against Netflix, Disney+, and other video-on-demand offers, Amazon Prime Video notably proposes exclusive content from Amazon Studios which is specialized in developing, distributing, and producing television series and films.

Prime Video is a video-on-demand service. Competing against Netflix, Disney+, and other video-on-demand offers, Amazon Prime Video notably proposes exclusive content from Amazon Studios which is specialized in developing, distributing, and producing television series and films.

Besides Prime and Prime Video, Amazon also offers subscription services for music, through Amazon Prime Music and personal cloud storage, with Amazon Drive. Both services are included in the Prime premium subscription.

Amazon diversifying its sources of revenue

In its annual reports 2019, Amazon categorizes the revenues from its different stores, products, and services in five key sources. In 2019, the company’s total net sales have come up to $280.5 billion, representing a staggering growth of +20.5% for a company of this size, compared to 2018, which comfortably seats Amazon in the largest American companies.

The main source of revenue, retail sales, regroups the sales of consumer products to customers, with a transfer of goods, therefore excluding the sales of services that are part of other segments. Retail sales are then subdivided between online and physical stores.

By far the largest purveyor of revenues, the online stores account for the sales of products taking place on the company’s different websites, including amazon.com and the other local stores in the Americas, Europe, and Asia, such as amazon.de, amazon.co.uk, amazon.co.jp, etc.

The physical stores regroup the sales of products from Amazon Stores and other brick-and-mortar stores, including the Whole Foods Market hypermarkets in the United States and the United Kingdom. (See below for more information on this subsidiary.)

The other segments stand for the surrounding or supporting activities to the retail operations, and its separate cloud services subsidiary.

The third-party seller services summarize the revenues from Amazon’s programs enabling third-parties and individuals to sell their products in its stores, serving as marketplaces for others. It collects commissions from these third-parties, and shipping fees when the company’s delivery services are chosen.

The subscription services include the fees from Amazon Prime membership, providing fast-delivery, and other benefits, including access to its digital content: e-books and audiobooks, digital video, and music, which are also sold as standalone services.

AWS stands for the activities of the Amazon Web Services subsidiary, one of the key levers for growth and diversification from e-commerce. It regroups compute, storage, database, and other cloud activities delivered to start-ups, enterprises, government agencies, and academic institutions.

Other activities account for sources of revenues that are not recorded previously. These activities primarily include the advertising services provided as pay-per-click to third-parties on the Amazon websites.

Embed code:

<a href="https://blog.disfold.com/how-amazon-makes-uses-billions/" target="_blank" rel="noopener noreferrer"><img src="https://blog.disfold.com/wp-content/uploads/2020/04/amazon-revenue-streams-2019.jpg" alt="Revenue Streams of Amazon in 2019"></a>

- Online stores: $141.2 B – 50.4% of total net sales (+14.8% vs. 2018)

- Physical stores: $17.2 B – 6.1% of total net sales (-0.2% vs. 2018)

- Third-party seller services: $53.8 B – 19.2% of total net sales (+25.8% vs. 2018)

- Subscription services: $19.2 B – 6.8% of total net sales (+35.6% vs. 2018)

- AWS: $35.0 B – 12.5% of total net sales (+36.5% vs. 2018)

- Other: $14.1 B – 5.0% of total net sales (+39.3% vs. 2018)

- Total: $280.5 B (+20.5% vs. 2018)

Amazon’s geographic distribution of revenues in 2019

Diving deeper into Amazon’s activities around the world, the annual report also details some information about the geographic origin of its revenues. Dissecting the aggregated revenues from its three key segments (North America, International, and AWS) by countries, the report demonstrates how the United States remains overwhelmingly important for Amazon.

- United States: $193.6 B – 69.0% of total net sales (+20.9% vs. 2018)

- Germany: $22.2 B – 7.9% of total net sales (+11.8% vs. 2018)

- United Kingdom: $17.5 B – 6.2% of total net sales (+20.7% vs. 2018)

- Japan: $16.0 B – 5.7% of total net sales (+15.7% vs. 2018)

- Rest of world: $31.1 B – 11.1% of total net sales (+27.0% vs. 2018)

- Total: $280.5 B (+20.5% vs. 2018)

Amazon’s growing operating costs

Amazon generates huge revenues from the online and physical sales of products, commissions, and fees, but its costs base is also very large. Even though net sales now cover costs and generate a large profit, the company has been operating for many years at a loss, relying upon investors’ funding their belief in its future success. These investors now reap the benefits of Amazon’s enormous sales and profits, but the company’s costs nonetheless remain important and steadily increasing.

The largest expense of all, cost of sales includes the purchase price of consumer products, inbound and outbound shipping costs and sortation and delivery centers, if Amazon is the transportation service provider, as well as hosting and distribution costs for digital media.

Fulfillment primarily includes the operating and staffing costs from North America and International fulfillment centers, physical stores, and customer service centers. These costs notably account for receiving, warehousing, packaging, and preparing shipments for goods, processing payments, the supply chain for Amazon’s electronic devices, and payments to third-party services for these operations.

Technology and content costs consist of payroll for employees in research and development, development, design, and maintenance of stores, creation and display of products and services, and infrastructures, such as servers and networking equipment, rent, utilities, and support expenses for Amazon and AWS.

Marketing costs primarily include advertising spend and payroll for employees in marketing and selling operations. They also include sales commissions for AWS and commissions paid to third-parties referring sales for Amazon.

General and administrative costs primarily consist of corporate functions, including payroll, facilities and equipment expenses, and professional and litigation fees.

Other operating expenses consist of other assets amortization and legal settlement expenses.

Amazon’s operating costs in 2019

- Cost of sales: $165.5B – 62.2% of total costs (+19.0% vs. 2018)

- Fulfillment: $40.2B – 15.1% of total costs (+18.2% vs. 2018)

- Technology and content: $35.9B – 13.5% of total costs (+24.6% vs. 2018)

- Marketing: $18.9 – 7.1% of total costs (+36.7% vs. 2018)

- General and administrative: $5.2 – 2.0% of total costs (+20.0% vs. 2018)

- Other: $0.2 – 0.1% of total costs (-32.1% vs. 2018)

- Total operating costs: $266.0 (+20.6% vs. 2018)

The colossal profits of Amazon

One of the most interesting metrics to analyze for Amazon, its profits say a lot about the company’s perspective for the future. Even though the online and physical retail operations represent more than half of its revenues for 2019, the largest contributor to Amazon’s enormous profits is Amazon Web Services – AWS.

In 2019, the retail operations (online and physical stores) in North America bring an operating income of more than $7 billion, slightly below 2018 which saw a very large increase from 2017. But the International retail operations still generate an operating loss of about $1.7 billion, even though this loss has been steadily diminishing year over year.

Embed code:

<a href="https://blog.disfold.com/how-amazon-makes-uses-billions/" target="_blank" rel="noopener noreferrer"><img src="https://blog.disfold.com/wp-content/uploads/2020/04/amazon-income-profits-2019.jpg" alt="Income and Profits of Amazon in 2019"></a>

However, when the operating income of AWS comes into play, the strategic importance of this key subsidiary becomes flagrant. Not only does it contribute more than $9.2 billion of operating income, or 63.3% of Amazon’s total operating income, but the trend for AWS seems to be anchored on solid and rapid growth.

In the end, with a total of $11.6 billion in profits, Amazon will easily fight the crisis brought by the Coronavirus and have some free cash to fuel its appetite for geographic and scope expansion in retail, with some extra bet in other industries.

Investments: how Amazon spends its billions

Now that the picture of where Amazon’s current revenues and profits come from is clear, the e-commerce and cloud giant’s future seems bright. However, to understand where its leaders want to take the retail and AWS businesses and venture further into, a look to the goals and threats stated by its direction can bring some more enlightenment.

Amazon’s goals and threats

In its annual report, Amazon set the companies’ key focus and goals forth. These remarks are critical to grasp the company’s current operations and future strategic moves and investments; some of the most important points can be summarized as follows:

- Amazon’s main source of revenue comes from the sale of products and services to customers, which allows it to turn its inventory quickly and have a cash-generating operating cycle.

- Amazon’s financial focus is on long-term, sustainable growth in free cash flows.

- Amazon seeks to reduce its variable costs per unit and work to leverage its fixed costs.

- Amazon expects its spending in technology and content to increase. It will hire more tech-focused employees, invest in technology and content to support its geographic expansion, the cross-functionality of its systems and operations, grow AWS, and its technology infrastructure.

The annual report also expounds on a number of risk factors that weigh in Amazon’s investment decisions. They can be summed up as follows:

- Competition against Amazon’s key businesses is intense and intensifying.

- Amazon’s global expansion utilizes a lot of the company’s managerial, operational, financial, and other resources, and exposes the company to a number of risks. Its expansion of scope with new products, services, and technologies also brings new additional risks.

- It is subject to significant fluctuations in operating results and growth rate due to a large number of factors affecting all aspects of its businesses, and important seasonality of activities.

- Amazon faces specific risks on its fulfillment and data centers and increasing complexity to anticipate demand, optimize inventories, and manage inbound and outbound shipping.

- It is exposed to a number of risks from its agreements, alliances, and partnerships with other businesses, as well as with suppliers and government contracts.

- Amazon is also subject to the more common risks of successfully integrating its acquisitions and investments, foreign exchange, hiring and retaining top talents in senior positions, data, technical infrastructure, and inventory security, intellectual property protection, intellectual property infringement claims and other lawsuits, and fraud.

- Amazon’s business model is rapidly changing and its stock price is highly volatile.

- Government regulation is changing and could negatively impact Amazon. Tax liability and collection obligation are increasing.

With these goals and threats openly expressed, the general direction that Amazon is taking is obvious: grow its sales, reduce variable costs, decrease exposure to external risks, invest in tech and infrastructure. This general intention is further manifested by the acquisitions and investments that have already been concluded.

Amazon’s acquisitions and internal ventures

Amazon has reached its enormous size through a frantic dedication to customer satisfaction, rationalization of processes, and consolidation of its hold on the global e-commerce industry. Yet, to hedge the inherent risk from being involved in a single industry, it is also actively seeking to diversify to other related businesses.

First and foremost among all its daughter companies, Amazon’s largest subsidiary, Amazon Web Services, is an indisputable success. AWS has grown from an internal suite of tools, to become a sizable multinational tech corporation in itself, and a key purveyor of profits to the mother company. But the mother company has also acquired a number of other companies, to expand through both the retail and technology sectors.

First and foremost among all its daughter companies, Amazon’s largest subsidiary, Amazon Web Services, is an indisputable success. AWS has grown from an internal suite of tools, to become a sizable multinational tech corporation in itself, and a key purveyor of profits to the mother company. But the mother company has also acquired a number of other companies, to expand through both the retail and technology sectors.

Key acquisitions of Amazon

In recent years, Amazon has been aggressively consolidating its presence in e-commerce and the more traditional, physical retail sector, following an array of previously more diverse acquisitions.

In 2019, Amazon acquired companies for a total of $315 million for their customer-serving technologies and know-how. Such “smaller” acquisitions are common for the company, which spends a few tens or hundreds of millions every year for that purpose. 2019 was a rather small year for spending on acquisitions if it is compared to the more substantial acquisitions of previous years.

In 2018, Amazon went on purchasing larger companies to expand its own offer of products and services. It bought Ring, a company producing wifi-enabled video doorbells, for about $839 million. Now integrated into the portfolio of electronic equipment sold through Amazon’s stores, Ring provides a diversified range of smart doorbells, cameras, and visiophones.

In 2018, Amazon went on purchasing larger companies to expand its own offer of products and services. It bought Ring, a company producing wifi-enabled video doorbells, for about $839 million. Now integrated into the portfolio of electronic equipment sold through Amazon’s stores, Ring provides a diversified range of smart doorbells, cameras, and visiophones.

This year, Amazon also bought PillPack, an online pharmacy that also operates in medication packaging and delivery for about $753 million. This company continues as a separate business to focus on the pharmacy business and provide a range of services associated with healthcare and medication.

This year, Amazon also bought PillPack, an online pharmacy that also operates in medication packaging and delivery for about $753 million. This company continues as a separate business to focus on the pharmacy business and provide a range of services associated with healthcare and medication.

The 2018 purchases followed even more substantial acquisitions to expand its presence in digital and physical retail in 2017. Amazon acquired Souq Group, an e-commerce company with a strong presence in the Middle East, for $ 583 million. Souq was rebranded as amazon.ae to take a foothold in the United Arab Emirates, but it continues to remain Souq.com in Saudi Arabia and Egypt.

The 2018 purchases followed even more substantial acquisitions to expand its presence in digital and physical retail in 2017. Amazon acquired Souq Group, an e-commerce company with a strong presence in the Middle East, for $ 583 million. Souq was rebranded as amazon.ae to take a foothold in the United Arab Emirates, but it continues to remain Souq.com in Saudi Arabia and Egypt.

However, the largest acquisition of Amazon, by far, was the purchase of Whole Foods Market, a multinational chain of supermarkets for $13.2 billion, with more than 500 supermarkets in the United States and 7 in the United Kingdom. Kept as a separate brand, Whole Foods Market is specialized in organic foods, distributing products without hydrogenated fats and artificial colors, flavors, and preservatives, and it gave Amazon a strong foothold in traditional, physical retail.

However, the largest acquisition of Amazon, by far, was the purchase of Whole Foods Market, a multinational chain of supermarkets for $13.2 billion, with more than 500 supermarkets in the United States and 7 in the United Kingdom. Kept as a separate brand, Whole Foods Market is specialized in organic foods, distributing products without hydrogenated fats and artificial colors, flavors, and preservatives, and it gave Amazon a strong foothold in traditional, physical retail.

These recent purchases followed a series of previous acquisitions in the previous years and decades. Among these, a few companies stand out for their strategic importance and value. The deal concluded for Zappos.com in 2009 is one of them, when Amazon bought this specialist in the online retail of clothing and accessories for $1.2 billion. Zappos was also kept as a separate business.

These recent purchases followed a series of previous acquisitions in the previous years and decades. Among these, a few companies stand out for their strategic importance and value. The deal concluded for Zappos.com in 2009 is one of them, when Amazon bought this specialist in the online retail of clothing and accessories for $1.2 billion. Zappos was also kept as a separate business.

Another key move was the acquisition of Twitch, a video game platform, and community, in 2014 for $970 million. Now one of the key platforms of user-generated video content, and an important competitor to Youtube in the segment of video games and e-sports, Twitch has become a leader in live-streaming video and one of the world’s most visited websites.

Another key move was the acquisition of Twitch, a video game platform, and community, in 2014 for $970 million. Now one of the key platforms of user-generated video content, and an important competitor to Youtube in the segment of video games and e-sports, Twitch has become a leader in live-streaming video and one of the world’s most visited websites.

Internal developments and ventures

Besides high-profile acquisitions designed to ensure the company’s hold on e-commerce and retail, cut down competition, and expand to other promising tech niches, Amazon is also progressing in the same rationale through a number of other, less prominent but highly strategic internal developments and acquisitions. Though these ventures are not as popular as AWS or its key acquisitions, they are worth mentioning for a full flavor of Amazon’s strategy for the years ahead.

Two key internal developments are to be remarked first for their critical importance. The internal research and development lab founded in 2004, Amazon Lab126, is especially involved in the development of the company’s electronic products, including Kindle and Echo. It is responsible for developing Amazon’s internal products offer, thus strengthening the company’s share in its total product sales margin.

The company is also actively involved in reducing its shipping costs, with the launch in 2016 of Amazon Maritime, a shipping company primarily operating in the shipments of goods from China to the United States. It is part of a broader effort to reduce and internalize the costs of shipping with the integration of the freight forwarding company Beijing Century Joyo Courier Services, and the development of other capacities in trucking and air freight.

A third key internal development stems from the acquisition of Kiva Sytems in 2012, which spearheaded a pivotal move in the rationalization and reduction of costs from Amazon’s fulfillment operations. Renamed Amazon Robotics, it is specialized in creating robotic fulfillment systems for the management of the company’s warehouses. Amazon Robotics is notably responsible for the famous automated fleet of more than 200,000 robots in charge of moving products around.

Finally, Amazon has also bought multiple other “smaller” companies involved in digital media and marketing, more e-commerce activities, digital products, and electronics to engage in more specific businesses.

- Annapurna Labs, a microelectronics company bought in 2015 for $ 350 million

- Audible.com, a producer and seller of spoken audio entertainment, information and educational programs for $ 300 million in 2008

- Alexa, and internet traffic analysis and marketing services company acquired in 1999 for $ 250 million

- Goodreads, a user-generated database of books, annotations, and reviews bought in 2013 for $ 150 million

- Woot, an internet retailer specialized in daily discounts for $ 110 million in 2010

- IMDb, an online database of movies and video entertainment reviews, acquired in 1998 for $ 55 million

It is worth noting that not all Amazon investments are successful. Even though it seemed a worthy bet at the time, Amazon invested a total of $759 million in 2010-2011 in Living Social, a company specialized in daily deals and group purchases. At that time the idea seemed brilliant, but the demise of Living Social has been as rapid as its debuts had been promising: it was acquired for nothing by Groupon in 2016. Amazon’s investment thus supposedly failed to bring any return at all, if not completely wasted away. Though the company does not say much about it, it seems that even the best make mistakes sometimes…

As a final note on its investments, one of the most interesting new projects of Amazon is the creation of Project Kuiper. The mission of this new venture, launched in 2018 and still in the preparation phase as of early 2020, is to launch a constellation of thousands of satellites to provide a connection to people who still do have basic access to the internet. An ambitious, and costly new project that will surely be interesting to follow in the coming years.

Leadership: Jeff Bezos and the direction of Amazon

In the end, the picture on how Amazon makes and uses its money would not be complete without mentioning its stakeholders, management team, and shareholders, prime decision-makers, and beneficiaries of the company’s operations.

At the top of them all, the founder of Amazon, Jeff Bezos, has now become the richest man on Earth thanks to the explosion of the value of its shares of the company. He currently holds the titles of President, Chief Executive Officer, Chairman of the Board of Directors of Amazon, and besides his stake in Amazon, he directly or indirectly owns a number of other companies and has invested large amounts of his own money in multiple other ventures.

At the top of them all, the founder of Amazon, Jeff Bezos, has now become the richest man on Earth thanks to the explosion of the value of its shares of the company. He currently holds the titles of President, Chief Executive Officer, Chairman of the Board of Directors of Amazon, and besides his stake in Amazon, he directly or indirectly owns a number of other companies and has invested large amounts of his own money in multiple other ventures.

Standing out among these investments, Jeff Bezos has launched and funded Blue Origin, an aerospace manufacturer and sub-orbital spaceflight services, he has acquired The Washington Post, one of the most prominent American newspaper and digital media. Thanks to his early prominence in the American tech sector and financial acumen, he also was among the early investors in Google, Twitter, Airbnb, Uber, and Grail, currently one of the most promising American startups.

Amazon C-suite and Board of Directors

Though he is at the helm of Amazon, Jeff Bezos was not alone to create such a smashing success in 25 years. Here is the complete list of the executive officers of Amazon as of the end of 2019.

- Jeff P. Bezos – President, Chief Executive Officer, Chairman of the Board

- Jeffrey M. Blackburn – Senior Vice President, Business Development

- Andrew R. Jassy – CEO Amazon Web Services

- Brian T. Olsavsky – Senior Vice President and Chief Financial Officer

- Shelley L. Reynolds – Vice President, Worldwide Controller, and Principal Accounting Officer

- Jeffrey A. Wilke – CEO Worldwide Consumer

- David A. Zapolsky – Senior Vice President, General Counsel, and Secretary

Next to the executive officers’ team, the board of directors provides assistance and insights to Jeff Bezos beyond the internal operations of Amazon. They form a “brain trust” of key people from other large companies and organizations to help Amazon’s executive direction in matters where their expertise might be useful. Amazon’s board of directors is constituted of the following members as of the end of 2019.

- Jeff Bezos – President, CEO, and Chairman

- Rosalind Brewer – Group President, and COO, Starbucks

- Jamie Gorelick – partner, Wilmer Cutler Pickering Hale, and Dorr

- Daniel P. Huttenlocher – Dean of the Schwarzman College of Computing at the Massachusetts Institute of Technology

- Judy McGrath – former CEO, MTV Networks

- Indra Nooyi – former CEO, PepsiCo

- Jon Rubinstein – former Chairman, and CEO, Palm, Inc.

- Thomas O. Ryder – former Chairman, and CEO, Reader’s Digest Association

- Patty Stonesifer – President, and CEO, Martha’s Table

- Wendell P. Weeks – Chairman, President, and CEO, Corning Inc.

Amazon’s shareholders

Finally, the picture of Amazon would not be complete without detailing the actual ownership structure of Amazon. These individual and institutional actors are the end owners of Amazon and the primary recipients of its financial gains.

Here again, Jeff Bezos reigns of over the shareholders. However, after his divorce from former wife and key Amazon stakeholder, MacKenzie Bezos, Jeff Bezos now owns about 12% of Amazon, following the sale of $1.8 Billion worth of his company share in early 2020.

MacKenzie Bezos, Jeff’s former wife, owns about 4% of Amazon, making her one of the world’s richest person, and the fourth richest woman in the world. The two other largest individual shareholders of Amazon are Andrew Jassy, founder and CEO of Amazon Web Services, and Jeffrey Wilke, CEO of Amazon Worldwide Consumer, both owning just a fraction of the company.

Besides individuals, a host of funds and institutional investors do however hold a significant portion of the company, of which the following own more than 1% in April 2020:

- The Vanguard Group – 6.30%

- BlackRock Fund Advisors – 3.55%

- SSgA Funds Management, Inc. – 3.40%

- Fidelity Management & Research Co. – 3.02%

- Rowe Price Associates, Inc. – 3.01%

- Geode Capital Management LLC – 1.19%

Here is our complete study on Amazon’s sales, profits, acquisitions, and investments. Have you ever bought products in their online or physical stores? Have you ever used AWS? Let us know if Amazon’s dedication to customer satisfaction is really effective in the comments below!

![Top 1200 UK Companies [FTSE All-Share + FTSE AIM All-Share] – Excel Download](http://store.disfold.com/wp-content/uploads/sites/11/2024/05/top-1200-uk-companies-ftseallshare-aimallshare-small.jpg)

![Top 500 Australian Companies [All Ordinaries] – Excel Download](http://store.disfold.com/wp-content/uploads/sites/11/2021/04/top-500-australian-companies-allordinaries-small.jpg)