The largest companies of Australia greatly impact the country’s economy, the dynamism of the region, and beyond. The thirty largest publicly traded Australian companies, top constituents of the ASX 200 index, are detailed with their activities, logos, and useful links.

In Australia, companies are incorporated as public limited companies – PLC – to get listed on the Australian Securities Exchange – ASX. Even though they have to comply with the regulations of the Australian Securities and Investments Commission, getting listed allows companies to gain access to capital from investors in exchange for a share of the company’s stock.

In Australia, companies are incorporated as public limited companies – PLC – to get listed on the Australian Securities Exchange – ASX. Even though they have to comply with the regulations of the Australian Securities and Investments Commission, getting listed allows companies to gain access to capital from investors in exchange for a share of the company’s stock.

Check our data platform for the latest ranking of Australian companies and ASX 200 companies, and our blog roundup for top Australian companies 2023.

The S&P/ASX 200 Index

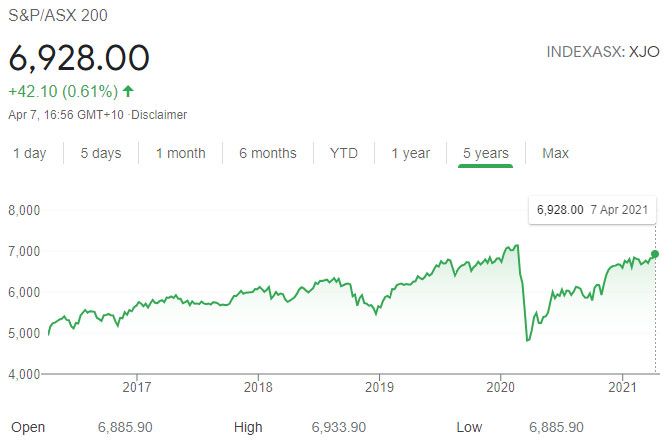

To easily grasp the fluctuations of the Australian economy and its stock market, the stocks of 200 companies quoted on the ASX are aggregated in the S&P/ASX 200 Index, or more simply ASX 200, which is widely considered as the benchmark index of Australia.

Calculated from the stocks of the 200 largest corporations by market capitalization listed on the Australian Securities Exchange, the ASX 200 is a capitalization-weighted index, i.e. in which larger companies are weighted more heavily. It represents more than 80% of the total market capitalization on the ASX.

Note that other indices have also been created to evaluate narrower or broader numbers of companies, and consider their economic dynamism through their size in market capitalization: S&P/ASX 20, S&P/ASX 50, S&P/ASX 100, and S&P/ASX 300. The S&P/ASX 200 Index remains however the index that is most often considered by analysts and journalists to follow the Australian stock market activity.

For more information on the largest Australian companies, download our ASX 200 companies Excel file containing the complete list of the 200 Australian companies that constitute the S&P/ASX 200 index, together with extensive business, market, financial, and digital information on each company. For even more data on the largest Australian companies, download our Excel file on the All Ordinaries companies (500 companies).

The real-time quotation of the ASX 200 index can be followed with convenient graphical tools from a number of sources, including Google Finance, Yahoo Finance, Bloomberg, etc.

For more information on other world-leading companies, check our series of posts on Top Companies, and for more information on the country, read our articles on Top Business Resources for Australia.

List of the 30 largest companies in the ASX by market capitalization

To help you learn more about Australian corporations, the 30 largest companies in the Australian Securities Exchange, and the ASX 200 index, are listed hereafter. Each company is presented with information on its sector and industry, operations, market capitalization, a direct link to its website, logo, and stock ticker. Companies are ranked by market capitalization in Australian Dollars as of the effective close on Friday, April 2, 2021.

Remark that in order to make this list follow the ASX 200 and focus on the largest Australian companies, we have not included companies that are not primarily or co-headquartered in Australia. A few of the larger companies in the ASX 200 index are therefore not in the following list, namely Resmed Inc, a US medical instruments & supplies company, Xero Limited, a cloud-based accounting software based in New-Zealand, News Corporation, a US media company, James Hardie Industries, a fiber cement company based in Ireland, and Fisher & Paykel Healthcare, a medical devices company from New Zealand.

Note that if you are searching for information on these companies to invest in their stocks, make sure you know what you are doing as your investment will be subject to significant risks with the evolution of stock prices. To learn more about investing in the stock market and managing your portfolio, check our post on the best online courses on stock investing and trading.

Shortcuts to each company

To facilitate your browsing in this long list, here are quick links to go directly to the details of any of the top 30 ASX companies. Be sure to also check the Top 10 Australian companies’ summary after the list!

30. QBE Insurance

![]() Sector: Financial Services – Industry: Property & Casualty Insurance

Sector: Financial Services – Industry: Property & Casualty Insurance

QBE Insurance Group Limited is a global insurance company. Tracing its origins to 1886, QBE Insurance Group operates in general insurance and reinsurance services in Australia, North America, Europe, and Asia Pacific region.

Website: qbe.com – Market Cap.: A$14.4 Billion – Stock ticker: QBE

29. Ramsay Health Care

Sector: Healthcare – Industry: Medical Care Facilities

Sector: Healthcare – Industry: Medical Care Facilities

Ramsay Health Care is a private healthcare company operating in Australia, France, the United Kingdom, Sweden, Norway, Denmark, Germany, Italy, Malaysia, Indonesia, and Hong Kong. Ramsay Health Care is especially involved in primary care to highly complex surgery, as well as mental health care and rehabilitation.

Website: ramsayhealth.com – Market Cap.: A$15.3 Billion – Stock ticker: RHC

28. Brambles

![]() Sector: Industrials – Industry: Specialty Business Services

Sector: Industrials – Industry: Specialty Business Services

Brambles Limited is the parent of Brambles group, a supply-chain logistics company, specialized in container pooling and associated services. Operating in more than 60 countries through the CHEP and IFCO brands, Brambles is engaged in outsourced management of pallets and containers and reusable plastic crates.

Website: brambles.com – Market Cap.: A$15.4 Billion – Stock ticker: BXB

27. Sydney Airport

Sector: Industrials – Industry: Airports & Air Services

Sector: Industrials – Industry: Airports & Air Services

Sydney Airport Holdings is a holding company that owns the Sydney Airport. It operates and manages the airport through the Sydney Airport Corporation.

Website: sydneyairport.com.au – Market Cap.: A$16.4 Billion – Stock ticker: SYD

26. Sonic Healthcare

![]() Sector: Healthcare – Industry: Medical Care Facilities

Sector: Healthcare – Industry: Medical Care Facilities

Sonic Healthcare Limited is a medical company specializing in diagnostics services. It provides services in pathology/laboratory medicine and imaging/radiology. Having grown through international acquisitions, Sonic Healthcare now operates in Australia, New Zealand, United States, United Kingdom, Germany, Switzerland, Belgium, and Ireland

Website: sonichealthcare.com – Market Cap.: A$16.9 Billion – Stock ticker: SHL

25. Charter Hall

![]() Sector: Real Estate – Industry: REIT—Diversified

Sector: Real Estate – Industry: REIT—Diversified

Charter Hall Group is a real estate developer and investor. Developing a number of office, industrial, retail and social infrastructure, Charter Hall operates through property investment and funds management. Charter Hall currently owns and manages more than 1300 real estate properties in its portfolio across Australia, including landmark city offices, industrial and logistics facilities, local shopping centers, and early learning centers.

Website: charterhall.com.au – Market Cap.: A$17.7 Billion – Stock ticker: CHC

24. REA Group

![]() Sector: Communication Services – Industry: Internet Content & Information

Sector: Communication Services – Industry: Internet Content & Information

REA Group Ltd is an online real estate advertising company. Originally operating Australia’s largest property website, realestate.com.au, REA Group has expanded through international acquisitions to operate property websites in 6 countries. It is majority-owned by News Corp Australia.

Website: rea-group.com – Market Cap.: A$18.8 Billion – Stock ticker: REA

23. Newcrest Mining

Sector: Basic Materials – Industry: Gold

Sector: Basic Materials – Industry: Gold

Newcrest Mining Limited is a mining company and one of the world’s largest producers of gold. It is involved in the exploration, development, mining, and sale of gold and copper, operating in Australia, Canada, Papua New Guinea, Indonesia, and Canada.

Website: newcrest.com – Market Cap.: A$20.4 Billion – Stock ticker: NCM

22. Coles

![]() Sector: Consumer Defensive – Industry: Grocery Stores

Sector: Consumer Defensive – Industry: Grocery Stores

Coles Group Limited is engaged in the operation of multiple retail chains. Previously bought by Wesfarmers Limited, Coles Group was relisted independently, operating Coles Supermarkets, Coles Express, Coles liquor division, and owning half of FlyBuys.

Website: colesgroup.com.au – Market Cap.: A$21.2 Billion – Stock ticker: COL

21. Aristocrat Leisure

![]() Sector: Communication Services – Industry: Electronic Gaming & Multimedia

Sector: Communication Services – Industry: Electronic Gaming & Multimedia

Aristocrat Leisure Limited is a company specialized in the manufacture of gambling machines. Primarily producing slot machines, it also develops computerized gambling systems and card game simulations, electronic table games, and linked jackpot systems. Besides Australia, Aristocrat Leisure has opened marketing and development offices in South Africa, Russia, and the United States.

Website: aristocrat.com – Market Cap.: A$22.2 Billion – Stock ticker: ALL

20. Woodside Petroleum

Sector: Energy – Industry: Oil & Gas E&P

Sector: Energy – Industry: Oil & Gas E&P

Woodside Petroleum is a petroleum exploration and production company. It operates in Australia, Canada, the United States, Senegal, the Republic of Korea, New Zealand, Myanmar, Cameroon, Gabon, Morocco, and Ireland. In Australia, Woodside is also involved in a number of liquefied natural gas projects.

Website: woodside.com.au – Market Cap.: A$23.1 Billion – Stock ticker: WPL

19. Amcor

![]() Sector: Consumer Cyclical – Industry: Packaging & Containers

Sector: Consumer Cyclical – Industry: Packaging & Containers

Amcor Limited is a multinational packaging company operating in more than 40 countries. It is engaged in the development and production of flexible packaging, rigid containers, specialty cartons, closures and services, and other products.

Website: amcor.com – Market Cap.: A$24 Billion – Stock ticker: AMC

18. Scentre Group

![]() Sector: Real Estate – Industry: REIT—Retail

Sector: Real Estate – Industry: REIT—Retail

Scentre Group is a company developing and managing shopping centers and retail destinations. Operating the Westfield brand across Australia and New Zealand, Scentre Group is operating through the development, design, construction, funds/asset management, property management, leasing, and marketing activities for its centers.

Website: scentregroup.com – Market Cap.: A$29.4 Billion – Stock ticker: SCG

17. Afterpay

![]() Sector: Technology – Industry: Software—Infrastructure

Sector: Technology – Industry: Software—Infrastructure

Afterpay Limited is a financial technology company primarily engaged in delayed payments. Thanks to its “pay later” service, Afterpay notably allows customers to purchase a product immediately, and pay it later in four payments within two weeks, whether in-store or online. Afterpay also provides special offers and deals with partner brands. Afterpay operates in Australia, Canada, the United Kingdom, the United States, and New Zealand.

Website: afterpay.com – Market Cap.: A$30.3 Billion – Stock ticker: APT

16. Goodman

Sector: Real Estate – Industry: REIT—Diversified

Sector: Real Estate – Industry: REIT—Diversified

Goodman Limited, also known as Goodman Group, is a commercial and industrial real estate development company. It is engaged in the management and development of commercial and industrial property including warehouses, large-scale logistics facilities, business and office parks in 17 countries.

Website: goodman.com – Market Cap.: A$33.8 Billion – Stock ticker: GMG

15. APA Group

Sector: Utilities – Industry: Utilities—Regulated Gas

Sector: Utilities – Industry: Utilities—Regulated Gas

APA Group is a company that owns and operates natural gas and electricity assets throughout Australia. Besides managing 15,000 kilometers of natural gas pipelines across Australia, APA Group is also involved in gas storage facilities, gas-fired power stations, and wind farms.

Website: apa.com.au – Market Cap.: A$35.8 Billion – Stock ticker: APA

14. Transurban

![]() Sector: Industrials – Industry: Infrastructure Operations

Sector: Industrials – Industry: Infrastructure Operations

Transurban Group, more simply know as Transurban, is a toll-road operating company. Transurban designs, builds, and manages urban toll road networks in Australia, the United States, and Canada. It is also engaged in the research and development of new toll payment systems and transport technology.

Website: transurban.com.au – Market Cap.: A$36.3 Billion – Stock ticker: TCL

13. Telstra

Sector: Communication Services – Industry: Telecom Services

Sector: Communication Services – Industry: Telecom Services

Telstra Corporation Limited, simply known as Telstra, the largest telecommunications company in Australia. It builds and operates telecommunications networks and markets products and services for voice, mobile, internet access, and pay television.

Website: telstra.com.au – Market Cap.: A$40.4 Billion – Stock ticker: TLS

12. Santos

![]() Sector: Energy – Industry: Oil & Gas E&P

Sector: Energy – Industry: Oil & Gas E&P

Santos Ltd., standing for South Australia Northern Territory Oil Search, is an independent oil and gas producer. Particularly involved in the extraction of domestic gas in Australia, Santos Ltd also distributes gas across the country. It is also engaged in oil and gas exploration and production ventures in Australia, in the Timor Gap, Indonesia, Papua New Guinea, India, Bangladesh, Egypt, Vietnam, and Kyrgyzstan, as well as the export of liquid natural gas to Japan.

Website: santos.com – Market Cap.: A$44.5 Billion – Stock ticker: STO

11. Woolworths

![]() Sector: Consumer Defensive – Industry: Grocery Stores

Sector: Consumer Defensive – Industry: Grocery Stores

Woolworths Group Limited is a retail company operating supermarkets (with the Woolworths and Countdown brands in Australia and New Zealand respectively), liquor retailing (as BWS and Dan Murphy’s in Australia), hotels and pubs (under the Australian Leisure and Hospitality Group), and discount department stores (under the Big W brand in Australia).

Website: woolworthsgroup.com.au – Market Cap.: A$51.8 Billion – Stock ticker: WOW

10. Macquarie Group

![]() Sector: Financial Services – Industry: Capital Markets

Sector: Financial Services – Industry: Capital Markets

Macquarie Group Limited is a multinational independent investment bank and financial services company. Employing more than 14,000 staff in 25 countries, Macquarie is the world’s largest infrastructure asset manager and top-ranked mergers and acquisitions advisor in Australia. It also manages more than A$ 495 billion in assets.

Website: macquarie.com – Market Cap.: A$55.1 Billion – Stock ticker: MQG

9. Wesfarmers

Sector: Consumer Cyclical – Industry: Home Improvement Retail

Sector: Consumer Cyclical – Industry: Home Improvement Retail

Wesfarmers Limited is a conglomerate with predominant interests in Australian and New Zealand retail, chemicals, fertilizers, coal mining, and industrial and safety products. Founded as a co-operative in 1914, Wesfarmers Limited has become the largest employer in Australia with more than 220,000 employees.

Website: wesfarmers.com.au – Market Cap.: A$60.1 Billion – Stock ticker: WES

8. Fortescue

Sector: Basic Materials – Industry: Industrial Metals & Mining

Sector: Basic Materials – Industry: Industrial Metals & Mining

Fortescue Metals Group Ltd, also referred to as Fortescue or FMG, is one of the largest producers of iron ore in the world. Fortescue Metals Group operates iron ore mines throughout Australia and ore transports including trains and ore carrying ships. It is now engaged in the exploration for diversification in gold, copper, and lithium.

Website: fmgl.com.au – Market Cap.: A$62.3 Billion – Stock ticker: FMG

7. ANZ

![]() Sector: Financial Services – Industry: Diversified Banks

Sector: Financial Services – Industry: Diversified Banks

The Australia and New Zealand Banking Group Limited, commonly called ANZ, is a multinational bank. The third-largest bank in Australia by market capitalization, ANZ is the largest bank in New Zealand, and it is also present in 34 other nations.

Website: anz.com.au – Market Cap.: A$80.4 Billion – Stock ticker: ANZ

6. NAB

Sector: Financial Services – Industry: Diversified Banks

Sector: Financial Services – Industry: Diversified Banks

National Australia Bank, commonly known and branded as NAB, is a multinational bank. Heavily present in Australia through business and personal banking, direct banking through the internet, and financial services, NAB is also very present in New Zealand and in other countries of Asia.

Website: nab.com.au – Market Cap.: A$86.1 Billion – Stock ticker: NAB

5. Westpac

Sector: Financial Services – Industry: Diversified Banks

Sector: Financial Services – Industry: Diversified Banks

Westpac Banking Corporation, commonly known as Westpac, is a bank and provider of financial services. Founded in 1817, Westpac now gathers more than 14 million customers in five divisions: consumer banking, commercial and business banking, wealth management, institutional banking, and Westpac New Zealand.

Website: westpac.com.au – Market Cap.: A$88.6 Billion – Stock ticker: WBC

4. CSL

Sector: Healthcare – Industry: Biotechnology

Sector: Healthcare – Industry: Biotechnology

CSL Limited is a biotechnology company providing products to treat and prevent serious human medical conditions. CSL is involved in the research, development, manufacturing, and marketing of a wide range of products including blood plasma derivatives, vaccines, antivenom, and cell culture reagents for medical and genetic research and manufacturing applications.

Website: csl.com.au – Market Cap.: A$119.7 Billion – Stock ticker: CSL

3. CommBank

Sector: Financial Services – Industry: Diversified Banks

Sector: Financial Services – Industry: Diversified Banks

The Commonwealth Bank of Australia, abbreviated CBA or CommBank, is a multinational bank providing services in retail, business, and institutional banking, funds management, superannuation, insurance, investment, and brokerage services. Founded in 1911, it now operates across Australia, and abroad in New Zealand, Asia, the United States, and the United Kingdom.

Website: commbank.com.au – Market Cap.: A$152.9 Billion – Stock ticker: CBA

2. Rio Tinto

Sector: Basic Materials – Industry: Industrial Metals & Mining

Sector: Basic Materials – Industry: Industrial Metals & Mining

Rio Tinto Limited is the Australian arm of the Anglo-Australian multinational metals and mining corporation that is also listed on the London Stock Exchange and a top constituent of the FTSE index. Founded in 1873, Rio Tinto has evolved to become a leader in the extraction of minerals, especially aluminum, iron ore, copper, uranium, and diamonds, and developed operations in refining, particularly for bauxite and iron ore. With a global presence, Rio Tinto is primarily operating in Australia and Canada.

Website: riotinto.com – Market Cap.: A$181.2 Billion – Stock ticker: RIO

1. BHP Group

Sector: Basic Materials – Industry: Industrial Metals & Mining

Sector: Basic Materials – Industry: Industrial Metals & Mining

BHP Group Limited is the Australian part of the Anglo-Australian multinational mining, metals, and petroleum corporation that is also listed on the London Stock Exchange and a top constituent of the FTSE index. BHP is involved in the exploration, production, and processing of minerals, especially coal, iron ore, copper, and manganese ore, and the exploration, production, and refining of hydrocarbons.

Website: bhp.com – Market Cap.: A$230.9 Billion – Stock ticker: BHP

Summary: Top 10 companies from Australia 2021

To give you a quick review of the largest companies in the S&P/ASX 200 index in 2021, here are the top 10 ASX companies by market capitalization as of April 2, 2021.

- BHP Group – A$ 230.9 Billion

- Rio Tinto – A$ 181.2 Billion

- Commonwealth Bank – A$ 152.9 Billion

- CSL – A$ 119.7 Billion

- Westpac – A$ 88.6 Billion

- NAB – A$ 86.1 Billion

- ANZ – A$ 80.4 Billion

- Fortescue – A$ 62.3 Billion

- Wesfarmers – A$ 60.1 Billion

- Macquarie Group – A$ 55.1 Billion

You will also find the top 10 in this synthesizing image that also regroups the information of each S&P/ASX 200 company with its industry. Remark that you can use this image to embed it on your website and other digital properties using the embed code below.

Embed code:

<a href="https://blog.disfold.com/top-companies-australia-asx/" target="_blank" rel="noopener noreferrer"><img src="https://blog.disfold.com/wp-content/uploads/2021/04/top-10-companies-asx.jpg" alt="Top 10 companies from Australia 2021"></a>

Here are the 30 largest public companies from Australia. Do you think they are worth their market capitalization? Are their stocks a good investment right now? Do they have too much economic power… and maybe political power too?

Leave your comments below!

![Top 1200 UK Companies [FTSE All-Share + FTSE AIM All-Share] – Excel Download](http://store.disfold.com/wp-content/uploads/sites/11/2024/05/top-1200-uk-companies-ftseallshare-aimallshare-small.jpg)

![Top 500 Australian Companies [All Ordinaries] – Excel Download](http://store.disfold.com/wp-content/uploads/sites/11/2021/04/top-500-australian-companies-allordinaries-small.jpg)

Is there a directory listing of ASX top 30 company’s addresses? Looking this up individually is tedious.

Hi,

If you’re interested, you can download ASX 200 companies’ data from our store.

Cheers!

What a well-detailed list of the top companies in Australia. Thanks a lot. I really appreciate the effort

Awesome and informative article, thank you for sharing valuable article.