Forget the stress of constant market watching and the confusion from conflicting opinions. The Disfold Daily Trading Experiment? A simple, yet powerful strategy with just a single, calculated action at each market close. Say goodbye to endless screen time and hello to focused, efficient trading.

The Mission: Simplify Trading

Our goal is clear: simplify trading. By focusing solely on daily closing prices, we eliminate market noise and emotional biases. This approach isn’t just about ease; it’s about intelligent, data-driven decision-making.

This 1-year journey started on Tuesday, January 2, 2024. This is not a suggestion to copy us, as we are actually experimenting if this approach works (maybe it doesn’t!), but stay tuned with our exciting experiment as we’ll be sure to share insights gathered along the way.

> Go directly to the TRADING LOG.

🚗Why Choose Tesla?

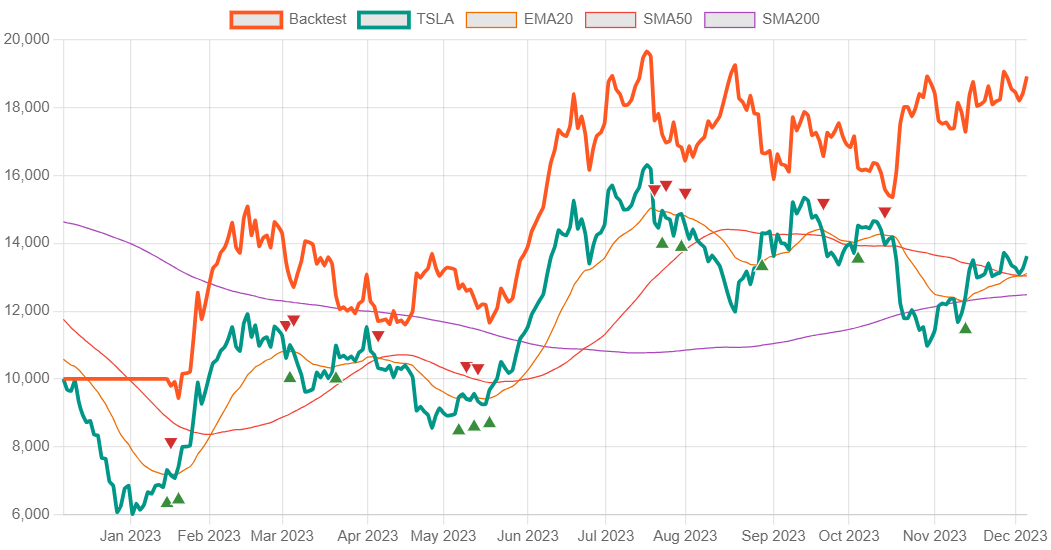

Tesla stands out for its market robustness and lower risk of manipulation, making it an ideal candidate for our experiment. Backtesting TSLA on Disfold AI suggests it can bring positive returns, if not beat the stock’s returns if it experiences large drawdowns. Yet, the real test lies ahead – applying this in real market conditions, considering actual prices and fees.

Tesla stands out for its market robustness and lower risk of manipulation, making it an ideal candidate for our experiment. Backtesting TSLA on Disfold AI suggests it can bring positive returns, if not beat the stock’s returns if it experiences large drawdowns. Yet, the real test lies ahead – applying this in real market conditions, considering actual prices and fees.

🚀Join the Journey

Follow our year-long adventure on Disfold’s X (formerly Twitter) profile, @DisfoldAI. Our daily updates will offer more than just trading actions; they’ll provide insights and results from our real-world testing. Join us in challenging conventional strategies and possibly rewriting the rules of trading.

💡Disfold AI: Your Gateway to Informed Investing & Trading

There’s more to this journey than just following. By subscribing to Disfold AI‘s premium data and tools, you notably gain access to extensive trading tools and strategies, applicable to over 1,200 stocks globally. It’s an opportunity to empower your entire investment strategy, not just with Tesla.

The Strategy & Execution: Harness Simplicity & Data

At the heart of the Disfold Daily Trading Experiment lies our commitment to simplicity and efficiency. We’ve chosen Tesla (TSLA) for this journey, a company renowned for its robust performance and lower risk of market manipulation. Our focus on TSLA offers a unique insight into effective trading practices.

The EMA-20 Crossover Strategy

Our strategy centers on the 20-Day Exponential Moving Average (EMA-20) crossover, applied at each day’s market close. This powerful yet straightforward tool captures the market’s momentum, allowing to beat a stock’s return if it experiences large moves up and down, or at least capture some gains from large moves up and protect capital from large moves down. Since the TSLA stock is known for its large swing, this strategy seems a good candidate to make a profit.

Acting only at market close, we base our decisions on the day’s closing price relative to the EMA-20, allowing for a calm, calculated trading style.

- CROSS UP: if the TSLA Close Price is above the EMA-20 while being below at the previous close, it’s a signal to BUY.

- CROSS DOWN: if the TSLA Close Price is below the EMA-20 while being above at the previous close, it’s a signal to SELL.

- NO CROSS: if the Close Price and the EMA20 end up in the same relative position 2 days in a row, this is considered an absence of signal for trading and therefore to stay in the same position as the previous day, making it a HOLD.

Theory Meets Practice

Backtesting on Disfold AI has shown this strategy’s potential to surpass ‘buy and hold’ methods for TSLA, make significant gains if the stock doesn’t exhibit large moves down, or protect capital if it does make large moves down.

Yet, real-world application with actual capital and real market conditions, including trading fees of $1 per trade from our reference platform, Interactive Brokers, is the ultimate test. Our goal is to validate a systematic approach in a live market environment with $5,000, buying and selling only entire stocks (no fractional shares), and focusing on more than just profit by paying attention to the actual buying and selling price and fees VS the theoretical closing price.

Remark that you can earn up to $1,000 of free IBKR Stock by opening an account on Interactive Brokers with my link! (You’re welcome!😊)

Avoiding Common Trading Pitfalls

We aim to avoid the pitfalls of emotional trading, daily market rumors, and manipulative investor opinions. Our data-driven approach to price action is designed to navigate the market with clarity and precision.

First Update: mitigating the buys/sells after large move up or down above or below the EMA

The first buy signal on Day 32 came after a large move up, with the Close price of TSLA widely above the EMA20: $200.45 > Close $196.13, while the first sell signal happened after a large move down: Close $193.76 < EMA20 $196.31. This resulted in a large loss over this initial trade.

To reduce such large potential loss, here are some techniques implemented in the next trades:

-On days of positive catalyst signals when the price is close to the EMA20, such as the disclosure of Elon Musk ownership of 20.5% of Tesla after the close of February 19 (rather than 13% he owned before), the stock could be bought at an earlier time than the close, as a large move up can be expected early on.

-Generally a buy limit order when below the EMA20, or a stop loss at the EMA20 when up can be set for the half the position. In essence this tactic can reduce the large move risk by half. Using only half the position might also be judicious as the cross over (down or up) during the trading day can be reversed too and cause an unnecessary buy/sell.

Accessible to All

This experiment is for everyone, from seasoned traders to beginners. Follow the Disfold Daily Trading Experiment on @DisfoldAI for transparent, day-to-day updates on every decision, trade, and insight.

The Results: Progress Reports & Interaction

The Disfold Daily Trading Experiment isn’t just a passive observation; it’s an interactive learning journey. Our goal is to make the art of trading accessible and comprehensible for everyone, regardless of their experience level. Make sure to leave your ideas, comments and questions here or on X.

📅Daily Reports on X

At each market close, we’ll update you on our actions – or lack thereof – via Disfold’s X (formerly Twitter) profile, @DisfoldAI. ‘Buy’ to ‘Sell’ or ‘Hold’ update will provide insights into the EMA-20 crossover strategy with Tesla. These updates are more than mere announcements; they’re an invitation for you to engage, share your thoughts, and participate in an ongoing dialogue. Follow the hashtag #DisfoldDailyTrade to make sure you don’t miss any update.

Disfold Trading Experiment – Day 1

🚀Kicking off the #DisfoldDailyTrade! A 1-Year challenge trading $TSLA along its EMA20! 🌟

Follow @DisfoldAI daily as we navigate the highs & lows of Tesla & the market. Will we thrive or dive?🤔Stay tuned to find out!

👇Today is super close!

— Disfold (@DisfoldAI) January 2, 2024

Real-Time Learning and Transparency

Transparency is a cornerstone of this experiment. Alongside our daily social media updates, we’re introducing a dedicated Trading Log section in a secondary page to this blog post. This log will detail the specifics of our trading actions, the reasoning behind each decision, and the resulting trading and Net Liquid value outcomes of our strategy. This approach offers a comprehensive view of the trades and their cumulative impact on our investment, providing a practical, real-world learning experience for both new and seasoned traders.

The Bigger Picture

Our experiment transcends individual trades. It’s a comprehensive exploration of market ups and downs, effectiveness and risk management of a simple, yet powerful strategy. Go further by subscribing to Disfold AI’s premium service to unlock access, among others features, to 6 different long-only and long-short trading strategies applied to more than 1,200 US, UK and global stocks. Come make better investment and trading decisions with Disfold AI.

Charting New Paths in Trading Together

As we embark on the Disfold Daily Trading Experiment, your involvement is vital. Your insights and strategies are not just welcomed – they are essential. Join us in this transformative journey! Whether you’re an experienced trader or just beginning your journey, your participation enriches this experience for everyone.

Impact Beyond Just Trades

This one-year journey, centered around Tesla and the EMA-20 strategy, extends beyond mere trading. It’s an exploration of a simple yet effective trading method. Through transparent sharing and regular updates, we aim to educate and possibly challenge traditional trading norms. This experiment, managed by me, Florian Bansac (@florianbansac), is not confined to the Disfold platform; its insights and outcomes have the potential to challenge how you approach investing and trading.

Your Role in Rethinking Trading

Your active participation – following our updates, engaging in discussions, and applying these insights – is what will truly define the success of this venture. We invite you to join, interact, and grow with us. Let’s delve into a strategy that has the potential to transform our investing and trading approaches and open new avenues for success.

Are you ready to embark on this unique trading adventure? The journey begins now!

![Top 1300 UK Companies [FTSE All-Share + FTSE AIM All-Share] – Excel Download](https://store.disfold.com/wp-content/uploads/sites/11/2021/03/top-1300-uk-companies-ftseallshare-aimallshare-small.jpg)