Are you tired of watching your hard-earned money languish in a low-interest savings account while others around you seem to be growing their wealth effortlessly? The stock market may hold the key to unlocking your financial potential, and this ultimate guide is here to help you get started.

This guide will take you through the essential steps of investing in the stock market, teach you how to build a diverse and profitable portfolio, and share expert advice to maximize your returns. Along the way, we’ll also uncover common mistakes to avoid, and delve into the crucial art of risk management for a successful investing journey.

Beginner’s Guide to Investing in the Stock Market: Summary

First steps for investing in the stock market

- Identify your goals

- Diversification

- Account size considerations

- Types of stocks

- Rebalance

- Costs and taxes

- Monitor performance

How to constitute a portfolio

How investors can improve their edge in stock picking

- Personal expertise and advantage

- Fundamental analysis

- Technical analysis

- Quantitative analysis

- Sentiment analysis

- Thematic investing

Risk management for successful investing

- Asset allocation

- Position sizing

- Stop-loss orders

- Risk-reward ratio

- Dollar-cost averaging

- Hedging

- Monitoring and rebalancing

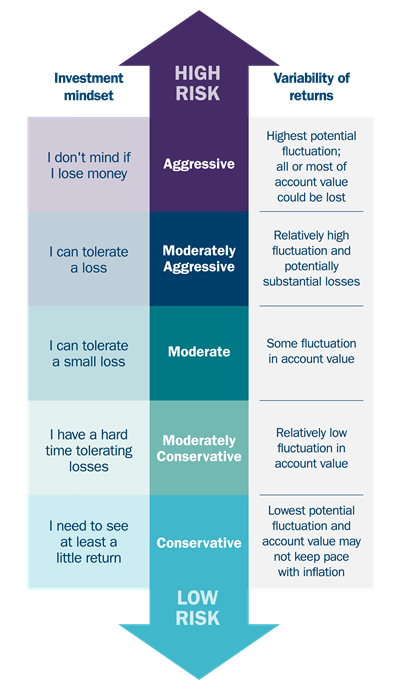

- Risk tolerance assessment

- Seeking professional advice

Mistakes to avoid while investing in the stock market

- Lack of a clear plan

- Insufficient diversification

- Emotional investing

- Market-timing

- Overtrading

- Ignoring fees and taxes

- Failing to monitor and rebalance

- Chasing performance

- Not doing your homework

- Overconfidence

Expert advice for investment in the stock market

With the right knowledge and tools at your disposal, you’ll be well on your way to making your money work harder for you. Now let’s dive right in!

First steps for investing in the stock market

When investing in the stock market, it’s crucial to tailor your portfolio according to your account size, goals, and risk tolerance. Here are some steps to help you build and manage a suitable portfolio.

1. Identify your goals

Determine your investment objectives, time horizon, and risk tolerance. Are you seeking long-term capital appreciation, income generation, or both? Understanding your goals will help you make informed decisions about the types of stocks and assets to include in your portfolio.

2. Diversification

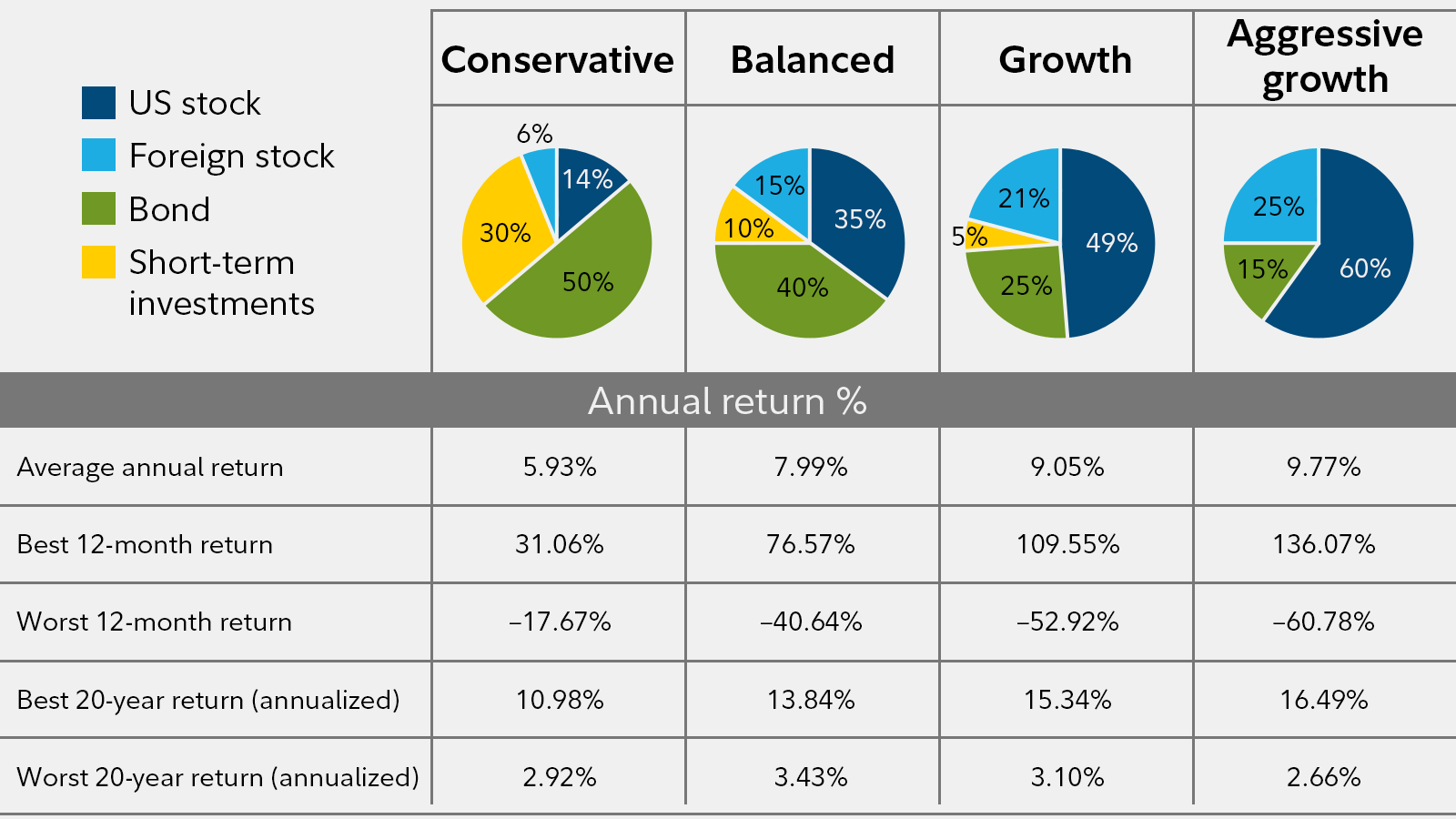

Diversify across different asset classes (stocks, bonds, commodities, real estate, etc.), sectors, and geographical regions. This reduces the risk associated with overexposure to a single asset or sector. The ideal number of stocks depends on your account size and risk tolerance; typically, holding between 20-30 stocks is considered sufficient for diversification.

However, if you are aiming for growth, have an appetite for risk, and an elaborate understanding of your investments, some renowned investor such as Warren Buffett suggests that too much diversification may lead to slow returns: “You know, we think diversification is—as practiced generally—makes very little sense for anyone that knows what they’re doing…it is a protection against ignorance.”

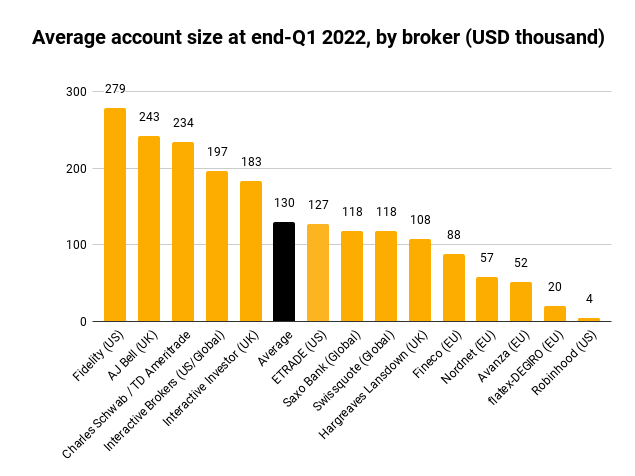

3. Account size considerations

If you have a smaller account, it may be difficult to diversify using individual stocks. In this case, consider using low-cost index funds, ETFs (Exchange-Traded Funds), or mutual funds to achieve a diversified portfolio. These investment vehicles pool money from multiple investors to buy a broader range of stocks, making them an accessible option for smaller accounts.

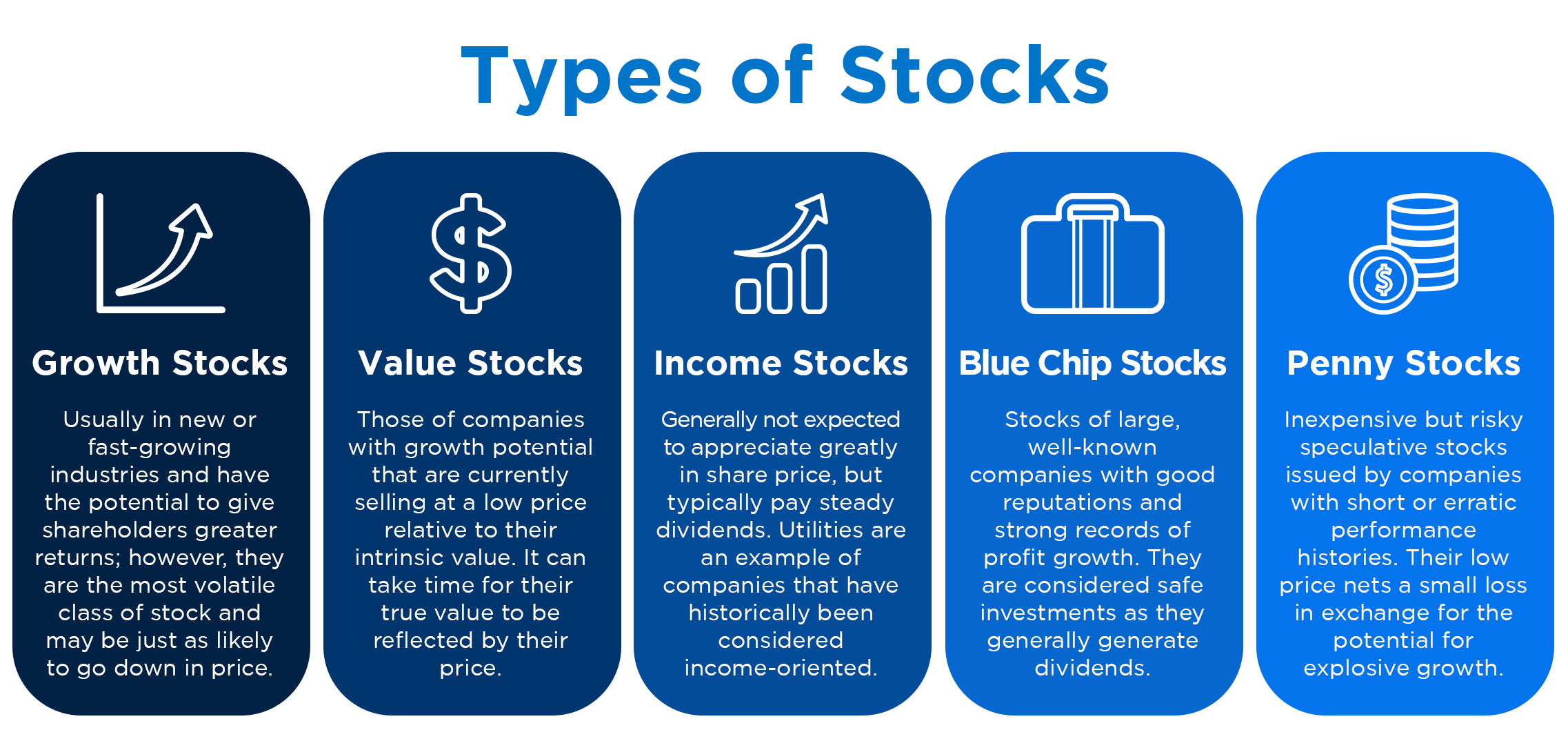

4. Types of stocks

To align your portfolio with your goals, include a mix of growth stocks (companies expected to grow earnings faster than the market), value stocks (undervalued companies with potential for growth), and dividend stocks (companies with a history of paying dividends). The proportions of each type of stock will depend on your objectives and risk tolerance.

5. Rebalance

Periodically review and adjust your portfolio to ensure it remains aligned with your goals and risk tolerance. Rebalancing may involve selling assets that have performed well and using the proceeds to buy underperforming assets, maintaining your target asset allocation.

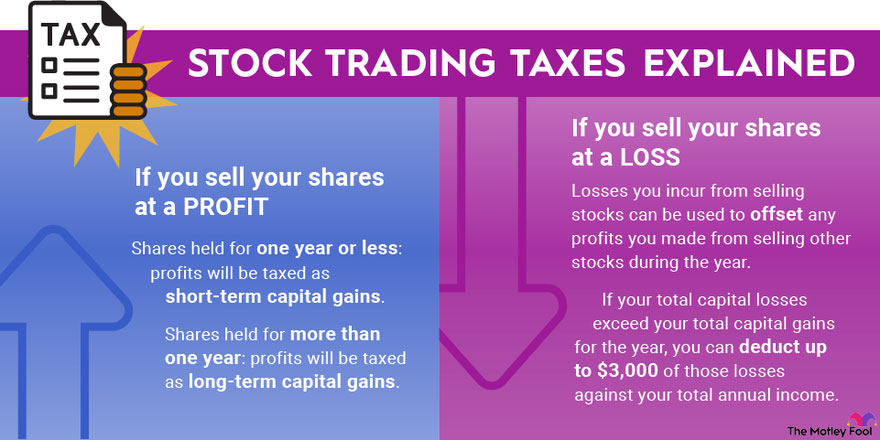

6. Costs and taxes

Be mindful of the costs associated with investing, such as trading fees, management fees, and taxes. Minimize these costs by opting for low-cost investment options and implementing tax-efficient strategies, such as holding investments in tax-advantaged accounts.

7. Monitor performance

Regularly review your portfolio’s performance and compare it to relevant benchmarks. This will help you identify areas for improvement and make informed decisions about adjusting your portfolio.

Remember that your investment strategy should be tailored to your specific circumstances, and it’s always a good idea to consult a financial advisor to help you create a portfolio that best suits your needs and goals.

How to constitute a portfolio

When selecting stocks and ETFs for different account sizes and objectives, it’s essential to choose investments that align with your goals and risk tolerance.

Here are three different scenarios to get some examples of where to start with a smaller portfolio (<$25,000) looking for short to mid-term growth, a medium-sized account ($50,000 to $150,000) aiming at income generation and long-term growth, and a larger account (>$200,000) looking for income generation, long-term capital growth, and protection of capital.

Each scenario will be addressed from the perspective of an investor based or interested in investing in the US, the UK, and internationally, to give you a general idea of how to approach the stock market. From there you can adapt to your own goals, needs, and risk tolerance.

In any case, make sure you understand what assets you want to buy and don’t skip getting more information, as this study is not financial advice, but just aims at giving a broad idea of how to apprehend stock market investment.

1. Smaller account (<$25,000) looking to maximize growth in the short to mid-term

For this type of account, focus on growth stocks and sector-based ETFs that have the potential for higher returns in the short to mid-term. Technology, healthcare, and green energy sectors could be appropriate targets.

US investment

- Stocks: Tesla (TSLA), Nvidia (NVDA), Palo Alto Networks (PANW)

- ETFs: ARK Innovation ETF (ARKK), Global X Cloud Computing ETF (CLOU), iShares PHLX Semiconductor ETF (SOXX)

UK investment

- Stocks: Ocado Group (OCDO), AstraZeneca (AZN), ASOS (ASC)

- ETFs: iShares UK Tech 100 ETF (CUKX), L&G Battery Value-Chain UCITS ETF (BATG), Lyxor Healthcare (DRUG)

International investment

- Stocks: Alibaba Group (BABA), Tencent Holdings (0700.HK), MercadoLibre (MELI)

- ETFs: iShares MSCI ACWI UCITS ETF (IWDA), Vanguard FTSE All-World UCITS ETF (VWRL), Global X MSCI SuperDividend EAFE ETF (EFAS)

2. Medium-sized account ($50,000-$150,000) aiming at income generation and long-term capital growth

For this type of account, focus on a mix of dividend-paying stocks, growth stocks, and diversified ETFs.

US investment

- Stocks: Apple (AAPL), Microsoft (MSFT), Johnson & Johnson (JNJ)

- ETFs: SPDR S&P 500 ETF Trust (SPY), Vanguard Total Stock Market ETF (VTI), Schwab U.S. Dividend Equity ETF (SCHD)

UK investment

- Stocks: Unilever (ULVR), GlaxoSmithKline (GSK), Legal & General Group (LGEN)

- ETFs: iShares Core FTSE 100 UCITS ETF (ISF), Vanguard FTSE 250 UCITS ETF (VMID), SPDR UK Dividend Aristocrats ETF (UKDV)

International investment

- Stocks: LVMH (MC), Roche Holding (ROG), Siemens (SIE)

- ETFs: iShares Core MSCI World UCITS ETF (SWDA), Xtrackers MSCI All World ex U.S. High Dividend Yield ETF (HDAW), Vanguard Global Equity Fund (VGVEF)

3. Large account (>$200,000) aiming at income generation, long-term capital growth, and protection of capital

For this type of account, focus on a mix of blue-chip dividend-paying stocks, growth stocks, and defensive sector ETFs, as well as bonds and other fixed-income assets for capital preservation.

US investment

- Stocks: Procter & Gamble (PG), Visa (V), Coca-Cola (KO)

- ETFs: iShares Edge MSCI Min Vol USA ETF (USMV), iShares TIPS Bond ETF (TIP), iShares iBoxx $ Investment Grade Corporate Bond ETF (LQD)

UK investment

- Stocks: Diageo (DGE), Reckitt Benckiser Group (RKT), National Grid (NG)

- ETFs: iShares GBP Corp Bond UCITS ETF (SLXX), iShares UK Dividend UCITS ETF (IUKD), iShares UK Property UCITS ETF (IUKP)

International investment

- ETFs: iShares Edge MSCI Min Vol Global UCITS ETF (MVOL), iShares Global Corp Bond UCITS ETF (CORP), SPDR Bloomberg Barclays Global Aggregate Bond UCITS ETF (AGGG)

Keep in mind that these are just examples and should not be considered financial or investment advice. It’s crucial to perform thorough research and consult with a financial advisor before making any investment decisions. Additionally, make sure to keep an eye on the current market conditions, as they can have a significant impact on the performance of stocks and ETFs.

How investors can improve their edge in stock picking

Getting started in the stock market is only a first step, you need to actually buy stocks, ETFs, or other financial assets in order to sell them at a higher price to make a profit. But what stocks to actually buy? And when? Here are tips to help you improve your edge in stock picking by leveraging your personal expertise and advantage, as well as employing various analysis frameworks.

Personal expertise and advantage

Investors with specialized knowledge or experience in a particular industry can leverage this understanding to identify potential investment opportunities. By staying informed about industry trends and developments, investors can gain insights into which companies are likely to outperform. Additionally, investors can network with professionals in their field to gain further insights and knowledge.

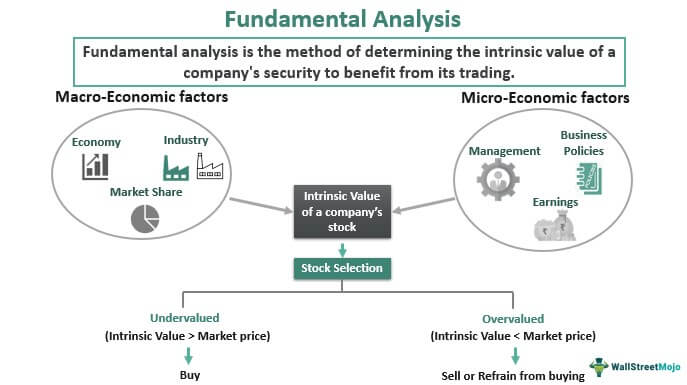

Fundamental analysis

This approach involves analyzing a company’s financial statements, management, competitive advantages, industry position, and growth prospects. By conducting thorough research, investors can determine a company’s intrinsic value and compare it to the current market price. If the intrinsic value is higher than the market price, the stock may be undervalued and a potential buying opportunity. Key financial ratios and metrics to consider include price-to-earnings (P/E) ratio, price-to-book (P/B) ratio, return on equity (ROE), and earnings growth.

Technical analysis

Technical analysis involves studying historical price patterns and market trends to predict future price movements. By using various charting tools and indicators, such as moving averages, trendlines, and relative strength index (RSI), investors can identify potential entry and exit points for their investments. Technical analysis can also help identify support and resistance levels, which can provide valuable information about the stock’s potential price movements.

Quantitative analysis

This approach involves using mathematical and statistical models to evaluate investment opportunities. Quantitative analysts, or “quants,” use algorithms and other quantitative tools to identify patterns and relationships between various factors, such as stock prices, earnings, and economic indicators. This data-driven approach can help investors make more objective investment decisions and minimize the impact of emotions on their decision-making process.

Sentiment analysis

Sentiment analysis involves examining market psychology and investor sentiment to assess potential stock price movements. By analyzing factors such as news articles, analyst reports, and social media posts, investors can gain insights into the overall market sentiment and use this information to inform their investment decisions.

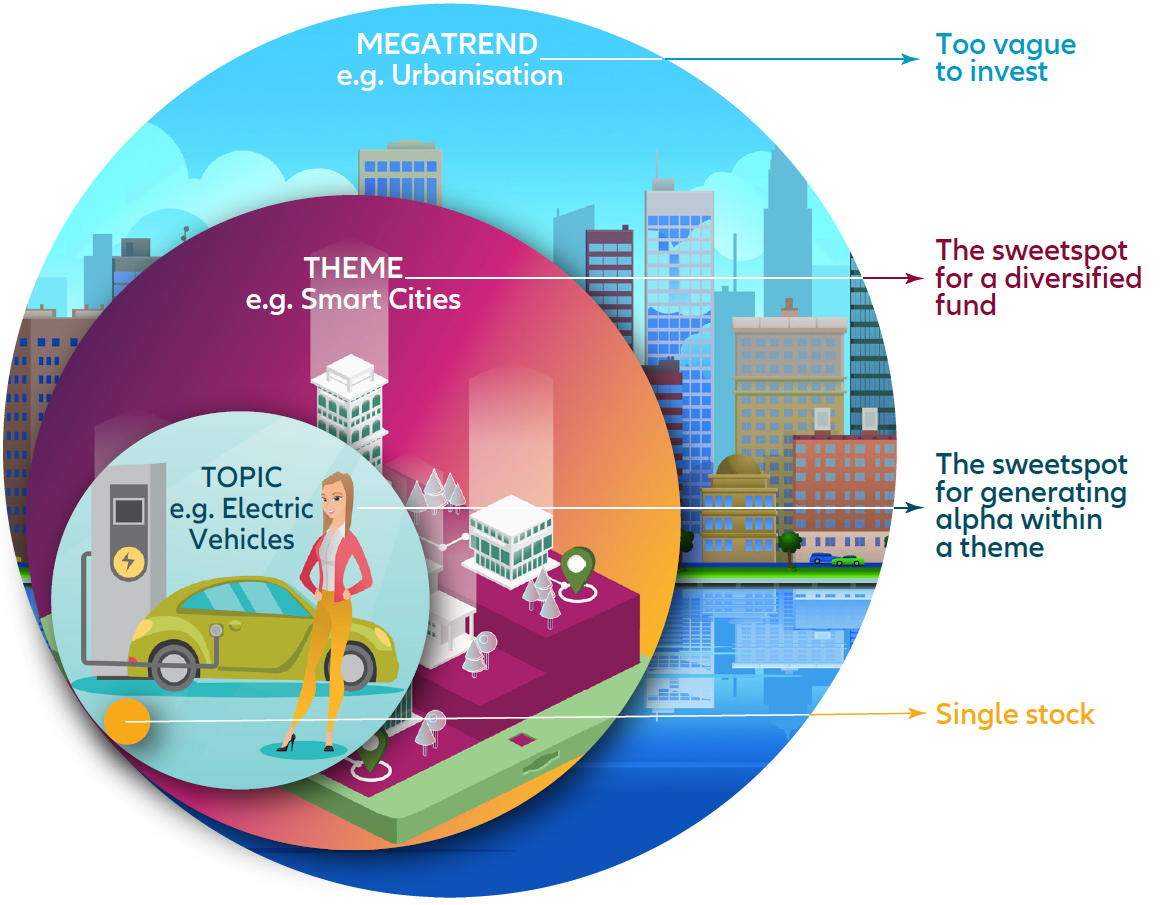

Thematic investing

Thematic investing involves identifying long-term trends or themes, such as technological advancements, demographic shifts, or environmental changes, and investing in companies that are expected to benefit from these trends. By focusing on the bigger picture, investors can potentially identify investment opportunities that are well-positioned for long-term growth.

By combining these various approaches and leveraging their personal expertise, investors can improve their stock-picking edge and make more informed investment decisions. It’s crucial to remember that no single approach is foolproof, and you should remain flexible and adaptable in your analysis. The most profitable trades often come from crossing multiple analyses and signals.

Risk management for successful investing

Effective risk management is crucial for long-term success in investing. Whether you invest in the long-term, swing trade with a short to medium-term horizon, or day trade for a quick profit, risk management is a critical and unavoidable part of partaking in the stock market. Here are some top tools and techniques investors can use to manage risk in their portfolios.

Asset allocation

Again, spreading investments across various asset classes, sectors, and geographical regions can help reduce portfolio risk. Diversification ensures that the performance of one asset or sector doesn’t overly influence the entire portfolio. A more conservative investor might opt for a higher percentage of bonds, while a more aggressive investor could allocate a larger portion of their portfolio to stocks.

Position sizing

Limiting the amount invested in any single asset can help reduce risk. By allocating a smaller percentage of the portfolio to each investment, investors can minimize the impact of a single stock’s poor performance on the overall portfolio.

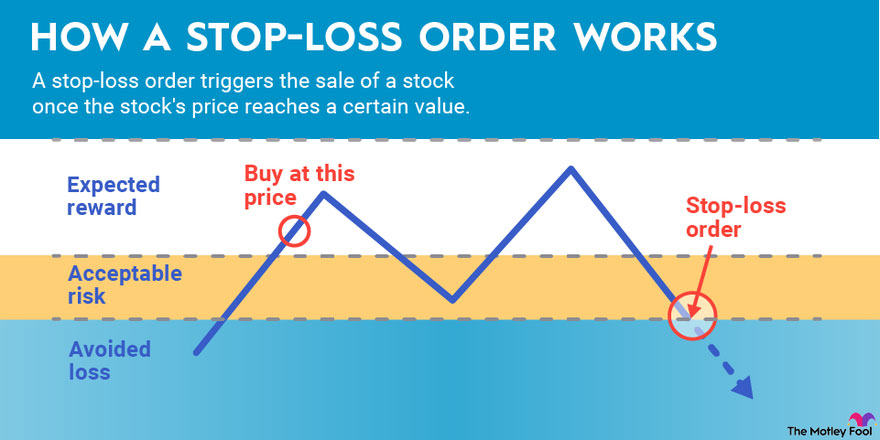

Stop-loss orders

Placing a stop-loss order on an investment can help limit potential losses. A stop-loss order is an instruction to sell a security when it reaches a certain price, effectively putting a cap on potential losses for that investment.

Risk-reward ratio

Evaluating the potential return of an investment relative to its potential risk can help investors make better-informed decisions. By analyzing the risk-reward ratio, investors can identify investments that offer favorable returns relative to their risk levels.

Dollar-cost averaging

Investing a fixed amount of money at regular intervals, regardless of market conditions, can help reduce risk by averaging out the purchase price of investments over time. This strategy helps mitigate the impact of market fluctuations and avoids the pitfalls of trying to time the market.

Hedging

Investors can use various financial instruments, such as options, futures, or inverse ETFs, to hedge against potential losses in their portfolios. Hedging involves taking an opposing position in a related security to offset potential losses in the primary investment.

Monitoring and rebalancing

Regularly reviewing and rebalancing the portfolio ensures that it remains aligned with the investor’s risk tolerance and investment objectives. Rebalancing involves selling assets that have performed well and using the proceeds to buy underperforming assets, thus maintaining the target asset allocation.

Risk tolerance assessment

Understanding one’s risk tolerance is essential for building a portfolio that aligns with an investor’s comfort level. By assessing risk tolerance, investors can create a portfolio that they can stick with during periods of market volatility.

Seeking professional advice

Consulting with a financial advisor can provide valuable guidance and support in managing risk. A financial advisor can help develop a personalized investment strategy, provide insights into market trends, and recommend suitable investment products.

By employing these tools and techniques, investors can effectively manage risk in their portfolios, enhancing their potential for long-term success and minimizing the potential downside of a market pull-back. Whatever you do in the stock market, remember that one of the most important rules is to always have a form of risk management in place!

Mistakes to avoid while investing in the stock market

When investing in the stock market, it’s essential to be aware of common mistakes and avoid them to improve your chances of success. Here are some common mistakes to watch out for as they are made over and over even by seasoned investors.

1. Lack of a clear plan

Before you start investing, establish a clear plan outlining your investment objectives, time horizon, and risk tolerance. A well-defined plan will help guide your decisions and keep you on track toward your goals.

2. Insufficient diversification

Failing to diversify your portfolio can expose you to unnecessary risk. Diversify across different asset classes, sectors, and geographical regions to minimize the impact of poor performance in any one area.

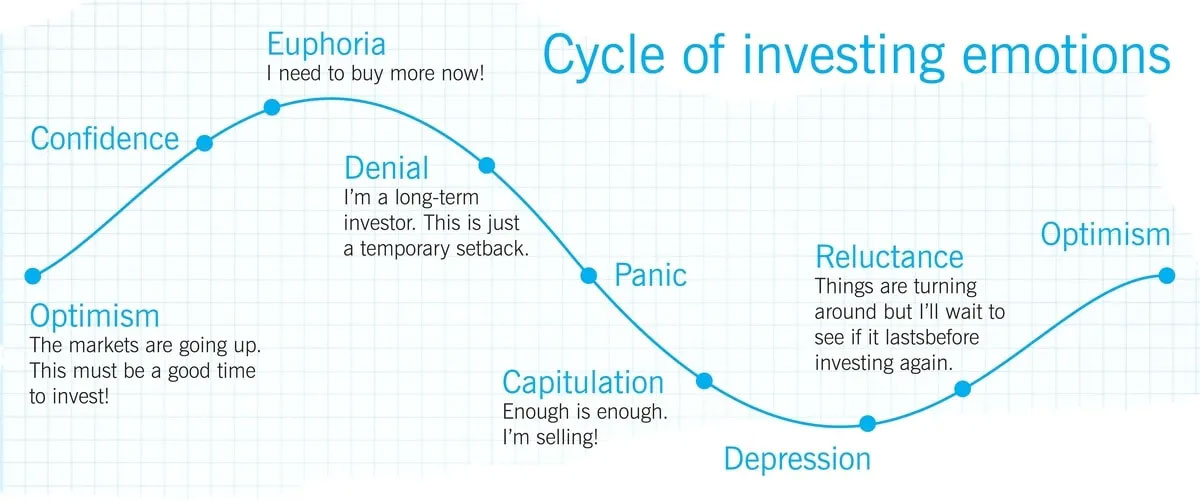

3. Emotional investing

Avoid making investment decisions based on emotions like fear, greed, or panic. Emotional investing can lead to poor decision-making and suboptimal outcomes. Stick to your plan and avoid being swayed by market fluctuations.

4. Market-timing

Attempting to time the market or predict its movements can be a costly mistake. It’s nearly impossible to consistently time the market correctly. Instead, focus on a long-term, buy-and-hold strategy.

5. Overtrading

Frequent buying and selling of stocks can lead to higher transaction costs and potential tax implications. Adopt a disciplined approach and avoid unnecessary trading.

6. Ignoring fees and taxes

Be aware of the costs associated with investing, including trading fees, management fees, and taxes. Minimize these costs by opting for low-cost investment options and implementing tax-efficient strategies.

7. Failing to monitor and rebalance

Regularly review your portfolio and rebalance it as needed to ensure it remains aligned with your goals and risk tolerance. Neglecting to do so can result in your portfolio becoming unbalanced and taking on more risk than intended.

8. Chasing performance

Avoid investing in assets solely based on their recent performance. Past performance is not indicative of future results, and chasing hot stocks or sectors can lead to increased risk and potential losses.

9. Not doing your homework

Conduct thorough research and due diligence before making any investment decisions. Understand the fundamentals of the companies you invest in and assess the risks associated with each investment.

10. Overconfidence

Overconfidence can lead to excessive risk-taking and poor decision-making. Be realistic about your abilities and knowledge, and consider seeking the advice of a professional financial advisor.

By avoiding these common mistakes and following a disciplined, well-researched investment approach, you can improve your chances of success in the stock market.

Expert advice for investment in the stock market

Over the years, many successful investors and experts have shared their wisdom and insights. Here are some tips from famous investors that can provide valuable guidance for navigating the stock market and developing a disciplined, informed investment approach.

“Rule No.1: Never lose money. Rule No.2: Never forget rule No.1.”

-Warren Buffett

This advice highlights the importance of preserving capital and avoiding investments that carry a high risk of loss.

“Know what you own, and know why you own it.”

-Peter Lynch

Lynch emphasizes the importance of understanding the companies and assets you invest in and having a clear rationale for each investment.

“The individual investor should act consistently as an investor and not as a speculator.”

-Benjamin Graham

Graham, known as the father of value investing, suggests that investors should focus on the fundamentals of a company rather than trying to profit from short-term market fluctuations.

“The four most dangerous words in investing are: ‘this time it’s different.'”

-Sir John Templeton

This quote serves as a reminder that history tends to repeat itself in the market, and investors should be cautious of narratives suggesting that the old rules no longer apply.

“The stock market is filled with individuals who know the price of everything but the value of nothing.”

-Philip Fisher

Fisher emphasizes the importance of focusing on the underlying value of investments rather than being swayed by short-term price movements.

“In general, it’s more important to know how to diversify well than it is to know how to pick the best assets.”

-Ray Dalio

Dalio, the founder of Bridgewater Associates, stresses the importance of diversification to protect against the inevitable mistakes investors will make.

“Buying good businesses at bargain prices is the secret to making lots of money.”

-Joel Greenblatt

Greenblatt, the author of “The Little Book That Beats the Market,” advocates for value investing and seeking out quality companies at attractive prices.

“You can’t predict. You can prepare.”

-Howard Marks

Marks, the co-founder of Oaktree Capital Management, underscores the importance of being prepared for various market scenarios rather than trying to predict the future.

“The single greatest edge an investor can have is a long-term orientation.”

-Seth Klarman

Klarman, the founder of the Baupost Group, highlights the benefits of adopting a long-term investment perspective.

“It’s waiting that helps you as an investor, and a lot of people just can’t stand to wait.”

-Charlie Munger

Warren Buffett’s business partner emphasizes the importance of patience in successful investing.

In conclusion, investing in the stock market can be a rewarding and fulfilling endeavor if approached with the right mindset, knowledge, and strategies. From setting clear investment goals and building a diversified portfolio to managing risks and learning from the wisdom of renowned investment experts, the journey to financial success is paved with valuable insights and lessons.

No matter the size of your account, the key to thriving in the stock market is understanding your objectives, being diligent in your research, and refining your strategies as you gain experience. By avoiding common mistakes and employing sound risk management techniques, you can enhance your chances of achieving your financial goals.

Remember that even the most successful investors have experienced setbacks and learned from their mistakes. Embrace the journey, remain adaptable, and continually seek to educate yourself on best practices and new developments in the investment world. As you venture into the stock market, let the insights and strategies in this blog post serve as a guide, and don’t be afraid to seek professional advice when needed.

Hopefully, you found this blog post helpful and informative! If so, please feel free to comment below and share your thoughts or experiences with investing in the stock market. Also, don’t hesitate to share this post on your social media profiles, as your friends and followers may find it valuable too. Together, let’s make the world of investing more accessible and successful for everyone. Happy investing!

![Top 1200 UK Companies [FTSE All-Share + FTSE AIM All-Share] – Excel Download](http://store.disfold.com/wp-content/uploads/sites/11/2024/05/top-1200-uk-companies-ftseallshare-aimallshare-small.jpg)

![Top 500 Australian Companies [All Ordinaries] – Excel Download](http://store.disfold.com/wp-content/uploads/sites/11/2021/04/top-500-australian-companies-allordinaries-small.jpg)