With the entry of private ventures in space and the successful development of reusable rockets, hundreds of startups spur a new era of exploratory and commercial use for space. As a number of new actors challenge traditional ones, space startups now create a wind of change in this new space.

The final flight of the NASA (the American National Aeronautics and Space Administration) space shuttle in 2011 has profoundly transformed how cargo and crew are sent into space and brought to the International Space Station. Relying solely upon Russian capabilities for a time, NASA has awarded the space transportation contract to SpaceX since 2020.

Since billionaire Elon Musk’s space company’s successful development and use of reusable rockets, SpaceX has been able to significantly decrease the cost of sending material and astronauts to space, compared to the previous NASA launchers. This success has pushed a number of other private companies to engage in this new era of space-faring.

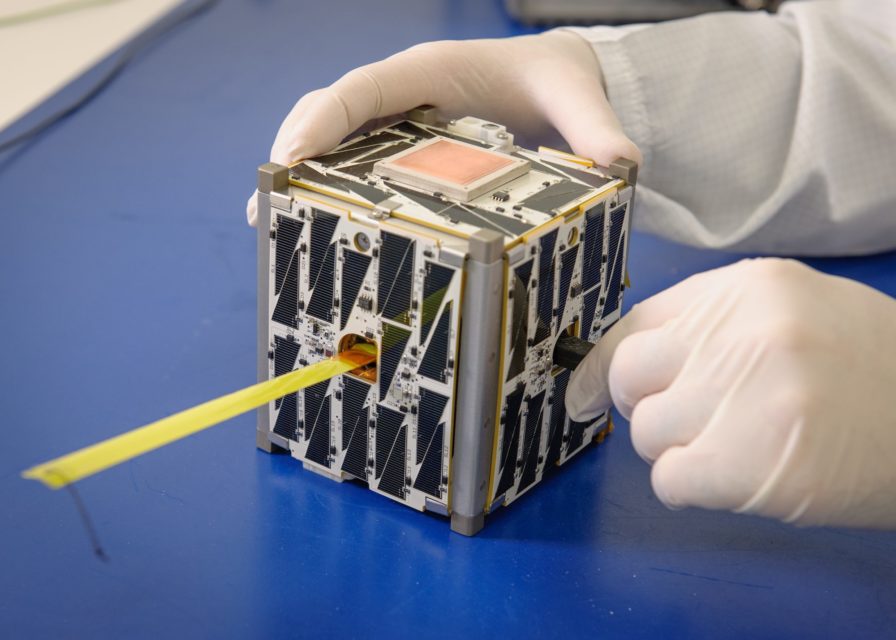

Thus a number of private companies have sprung around the world to provide space launching services at a fraction of the cost that was previously prohibitive. Furthermore, new developments in the design of miniature satellites, notably with the CubeSat modules of 10cm x 10cm x 10cm, multiple new uses of satellites and space activity have become cost-effective.

Besides Elon Musk, two other billionaires are also engaged in new spatial travel with their own companies. Jeff Bezos, the founder of Amazon, and his space company, Blue Origin, and Richard Branson, founder of Virgin and Virgin Galactic (which is already a listed company and thus not in the following list) are launching in July 2021 their first sub-orbital space travel flights.

In a domain which has traditionally been led by government-funded space agencies, NASA, the European Space Agency – ESA, the Japanese Aerospace Exploration Agency – JAXA, and serviced by giant aerospace and defense companies, such as the American Boeing, Lockheed Martin, Northrop Grumman or ArianeGroup in Europe, these new space startups and companies have a huge impact to open space to new private activities.

It’s important to highlight the new role of China in this new space race. Not only has the China National Space Administration – CNSA – pushed to develop the country’s space defense and commercial operations, but China also encourages and funds private companies to venture into space. A number of Chinese startups, therefore, make up the rank of the following best-funded space startups.

For the complete list of the world’s unicorn startups, download our 580 Unicorn Startups Excel file which includes valuations, funds raised, known investors, websites link, descriptions, and much more information on each company,

List of the world’s 30 top-funded Space startups

Without further ado, here is the list of the top 30 best-funded Space startups with details about each company, the total amount of funds received by the company according to Crunchbase and Wikipedia, as of July 2021, in US $, Euros €, Australian $, and Japanese ¥ (with conversion rates of 1,1865 $ per €, 0,75298 A$ per US $, and 110.99 ¥ per $), together with a direct link to the company’s website.

For more information on other world-leading startups, check our series of posts on Top Startups.

Shortcuts to each startup

To facilitate your browsing in this long list, here are quick links to go directly to the details of any of the world’s top 30 Space startups. Be sure to also check the Top 10 Space startups summary after the list!

30. World View

![]() Market: Near-space exploration, Geospatial data analytics – Total funding: $48.9 Million

Market: Near-space exploration, Geospatial data analytics – Total funding: $48.9 Million

World View Enterprises is a near-space exploration and geospatial data company. It develops stratospheric balloons and un-crewed flight vehicles for commercial and government customers to collect and use near-space Earth imagery data. World View also provides access to imagery and analytics products for a wide range of industries and applications.

Country: USA – Headquarters: Tucson, AZ – Founded: 2013

Website: worldview.space

29. Isotropic Systems

![]() Market: Satellite antennas – Total funding: $60 Million

Market: Satellite antennas – Total funding: $60 Million

Isotropic Systems is a satellite communication company. It develops antennas and terminals to support satellite broadcast, VSAT, microwave, multipoint wireless, and 5G broadband communications. Thanks to its advances in technology and innovative antenna design, Isotropic Systems aims at enabling high throughput satellites to reach new markets and scale to the mass market.

Country: UK – Headquarters: London – Founded: 2013

Website: isotropicsystems.com

28. Orbex

Market: Space launch – Total funding: $63.7 Million

Market: Space launch – Total funding: $63.7 Million

Orbex is a space manufacturing company and satellite launch service provider. It develops reusable rockets to launch small satellites into orbit. Thanks to its low carbon, high-performance micro-launch vehicles, and European launch site in Scotland, UK, Orbex provides a competitive satellite launch offer especially targeting European companies and public agencies.

Country: UK – Headquarters: Forres – Founded: 2015

Website: orbex.space

27. Moon Express

Market: Space robotics – Total funding: $65.5 Million

Market: Space robotics – Total funding: $65.5 Million

Moon Express is a space robotics technology for lunar payload services. It provides robotic space landers or orbiters for scientific and commercial exploration of the Moon. Moon Express aims at developing robotic spacecraft to ultimately engage in the mining of natural resources of economic value on the Moon, other planets, and celestial bodies.

Country: USA – Headquarters: Cape Canaveral, FL – Founded: 2010

Website: moonexpress.com

26. Gilmour Space

![]() Market: Space launch – Total funding: A$88 Million

Market: Space launch – Total funding: A$88 Million

Gilmour Space is a space manufacturing company and satellite launch service provider. It develops hybrid-engine rockets to launch small satellites to low Earth orbit. Focusing on satellites lighter than 400 kg, Gilmour Space aims at providing affordable Space launch services for satellites, human spaceflight, and space exploration.

Country: Australia – Headquarters: Helensvale, QLD – Founded: 2012

Website: gspacetech.com

25. Axelspace

![]() Market: Satellite developer, Geospatial data analytics – Total funding: ¥7.6 Billion

Market: Satellite developer, Geospatial data analytics – Total funding: ¥7.6 Billion

Axelspace is a commercial microsatellite developer. It collaborates with customers to design, build, launch and operate microsatellites according to their needs, in a wide range of activities including Earth monitoring, disaster prevention, space, vacuum and microgravity research, and many more. Besides, Axelspace also provides geospatial data imagery through its own satellites, with applications especially focused on agriculture, forestry, and infrastructure monitoring.

Country: Japan – Headquarters: Tokyo – Founded: 2008

Website: axelspace.com

24. Capella Space

Market: Geospatial data analytics – Total funding: $82 Million

Market: Geospatial data analytics – Total funding: $82 Million

Capella Space is a geospatial imaging data provider. Thanks to its constellation of satellites, it provides access to on-demand Earth observation imagery, and analytics solutions to detect changes, automate analysis and integrate workflows. Capella Space provides services to organizations in a number of industries, including defense, maritime, finance, and many more.

Country: USA – Headquarters: San Francisco, CA – Founded: 2016

Website: capellaspace.com

23. LeoLabs

![]() Market: Space surveillance – Total funding: $82 Million

Market: Space surveillance – Total funding: $82 Million

LeoLabs is a company specializing in space surveillance. It provides low Earth orbit mapping and space situational awareness services for satellite and debris tracking and monitoring, collision avoidance, launch, and early orbit securing. Thanks to its platform and API, LeoLabs allows customers to use its data directly to supervise their own satellites and space activities.

Country: USA – Headquarters: Menlo Park, CA – Founded: 2016

Website: leolabs.space

22. Kepler Communications

![]() Market: Satellite communication – Total funding: $85.1 Million

Market: Satellite communication – Total funding: $85.1 Million

Kepler Communications is a satellite communication company. It provides affordable network connectivity to other satellites and ground-based stations thanks to a constellation of small satellites. Kepler Communications aims at enabling IoT devices connectivity, data storing and forwarding services, and operation of other space-based assets.

Country: Canada – Headquarters: Toronto, ON – Founded: 2015

Website: keplercommunications.com

21. Kineis

Market: Satellite communication – Total funding: €100 Million

Market: Satellite communication – Total funding: €100 Million

Kineis is a satellite communication company specializing in data for Internet-of-Things devices. It designs, develops, and operates a constellation of satellites to provide connectivity for the IoT sector. It works with IoT manufacturers and operators, and satellite operators to collect from, and distribute data to devices around the world.

Country: France – Headquarters: Ramonville Saint-Agne – Founded: 2018

Website: kineis.com

20. OneSpace

Market: Space launch – Total funding: $120.2 Million

Market: Space launch – Total funding: $120.2 Million

OneSpace is a space manufacturing company and satellite launch service provider. It designs, develops, and manufactures a range of small rocket launchers to put microsatellites and nanosatellites into orbit, together with associated systems and technologies.

Country: China – Headquarters: Beijing – Founded: 2015

Website: onespacechina.com

19. Orbital Insight

![]() Market: Geospatial data analytics – Total funding: $128.7 Million

Market: Geospatial data analytics – Total funding: $128.7 Million

Orbital Insight is a geospatial data analytics company. It provides a platform that enables customers to use data from a constellation of satellites to discover, measure, and monitor activity around the world for better decision-making. Thanks to its geospatial and time data, and selection of algorithms, Orbital Insight empowers customers in a number of industries including defense, consumer goods, energy, real estate, and financial services.

Country: USA – Headquarters: Palo Alto, CA – Founded: 2013

Website: orbitalinsight.com

18. Ispace Technologies

![]() Market: Space robotics – Total funding: $128.8 Million

Market: Space robotics – Total funding: $128.8 Million

Ispace Technologies is a space robotic company for lunar and planetary missions. It designs, builds, and operates landers and rovers for transportation and exploration missions for public space agencies and private organizations. Its goal is to serve customers interested in the exploration and utilization of natural resources of the Moon.

Country: Japan – Headquarters: Tokyo – Founded: 2010

Website: ispace-inc.com

17. Axiom Space

![]() Market: Space infrastructure – Total funding: $150 Million

Market: Space infrastructure – Total funding: $150 Million

Axiom Space is a space infrastructure company. It designs, builds, and operates commercial space station modules connected to the International Space Station and plans to launch and operate the first commercial space station dedicated to human spaceflight, space tourism, in-space research, in-space manufacturing, and space exploration.

Country: USA – Headquarters: Houston, TX – Founded: 2016

Website: axiomspace.com

16. Iceye

![]() Market: Geospatial data analytics – Total funding: $152.1 Million

Market: Geospatial data analytics – Total funding: $152.1 Million

Iceye is a geospatial imaging data provider. It designs, develops, and operate a constellation of satellites dedicated to the collection of timely and reliable satellite imagery, which it then commercializes for governmental and commercial industries, with a number of applications in the industries of insurance, finance, energy, utilities, mining, maritime, civil and defense.

Country: Finland – Headquarters: Espoo – Founded: 2014

Website: iceye.com

15. HawkEye 360

![]()

Market: Geospatial data analytics – Total funding: $154.3 Million

HawkEye 360 is a geospatial analytics company. It is specializing in radio frequency signal location thanks to a constellation of small satellites. Thanks to the precise mapping of radiofrequency emissions, it empowers the operations of public and private organizations in the security and defense, maritime, telecommunications, and crisis response industries.

Country: USA – Headquarters: Herndon, VA – Founded: 2015

Website: he360.com

14. Reaction Engines

Market: Aerospace manufacturer – Total funding: $161.7 Million

Market: Aerospace manufacturer – Total funding: $161.7 Million

Reaction Engines is an aerospace manufacturer, specializing in rocket engines. Especially known for its innovative Synergetic Air-Breathing Rocket Engine (SABRE) which can propel both aircraft and spacecraft, Reaction Engines also develops technologies for cooling systems, precision machining, metal fabrication, and vacuum brazing and electroforming.

Country: UK – Headquarters: Abingdon – Founded: 1989

Website: reactionengines.co.uk

13. Isar Aerospace

![]() Market: Space launch – Total funding: $176.7 Million

Market: Space launch – Total funding: $176.7 Million

Isar Aerospace is a space manufacturing company and satellite launch service provider. It designs, develops, and manufactures launch vehicles dedicated to deploying and resupplying satellite constellations. With a focus on small satellites, it provides low-cost and environmentally-friendly space access and orbits for small and medium payloads.

Country: Germany – Headquarters: Munich – Founded: 2018

Website: isaraerospace.com

12. Astroscale

![]() Market: Orbital debris removal – Total funding: $204.2 Million

Market: Orbital debris removal – Total funding: $204.2 Million

Astroscale is an orbital debris removal company. It develops a range of on-orbit solutions and services to limit the hazard created by space debris and improve the long-term sustainable use of space, including satellite life extension, in situ space situational awareness, satellite end of life, and active debris removal.

Country: Japan – Headquarters: Tokyo – Founded: 2013

Website: astroscale.com

11. Astrobotic Technology

Market: Space robotics – Total funding: $212 Million

Market: Space robotics – Total funding: $212 Million

Astrobotic Technology is a space robotics technology for lunar and planetary missions. It designs, develops, and manufactures robotic landers and rovers to deliver the payload, stationary instruments, rovers, ascent vehicles, and even personal items on the moon. Astrobotic Technology also provides technology to deploy satellites in lunar orbit.

Country: USA – Headquarters: Pittsburgh, PA – Founded: 2008

Website: astrobotic.com

10. Rocket Lab

![]() Market: Space launch – Total funding: $215 Million

Market: Space launch – Total funding: $215 Million

Rocket Lab is a space manufacturing company and satellite launch service provider. It designs and develops sub-orbital and orbital lightweight and medium-lift rockets, systems, and technologies dedicated to the low-cost, high-frequency launches required by the emerging small satellite market.

Country: USA – Headquarters: Long Beach, CA – Founded: 2006

Website: rocketlabusa.com

9. Spire Global

![]() Market: Geospatial data analytics – Total funding: $222.7 Million

Market: Geospatial data analytics – Total funding: $222.7 Million

Spire Global is a multinational aerospace and data analytics company dedicated to weather and environment tracking. It designs and develops nanosatellites to monitor the weather and environmental conditions for the maritime, aviation, and weather-dependent industries. It operates from six offices in San Francisco, Boulder, Washington DC in the US, and Glasgow, UK, Luxembourg, and Singapore.

Country: USA – Headquarters: San Francisco, CA – Founded: 2012

Website: spire.com

8. iSpace China

Market: Space launch – Total funding: $276.5 Million

Market: Space launch – Total funding: $276.5 Million

Beijing Interstellar Glory Space Technology Co., Ltd., more simply known as iSpace, is a space and sub-orbital manufacturing and transport company. It designs, manufactures, and launches solid fuel small satellite orbital launchers, other reusable rockets, engines, and flight control systems for suborbital and orbital flight. iSpace also develops China’s first suborbital space tourism aircraft.

Country: China – Headquarters: Beijing – Founded: 2016

Website: i-space.com.cn

7. Kymeta

![]() Market: Satellite antennas – Total funding: $332.8 Million

Market: Satellite antennas – Total funding: $332.8 Million

Kymeta is a satellite communication company specializing in solutions for mobility. It develops lightweight and cost-effective satellite tracking antennas and terminals for mobile communications relying upon cutting-edge meta-materials. Its products are ideal for mass volumes communications where traditional satellite antennas are not practical or feasible, such as in the automotive, maritime, and aviation industries for defense, government, public safety, and commercial applications.

Country: USA – Headquarters: Redmond, WA – Founded: 2012

Website: kymetacorp.com

6. LandSpace

![]() Market: Space launch – Total funding: $336.1 Million

Market: Space launch – Total funding: $336.1 Million

LandSpace is a space manufacturing company and satellite launch service provider. Focusing on small and medium-scale commercial payloads, it develops, builds, and operates liquid-fueled orbital rockets, low-cost commercial launch vehicles, and propulsion systems primarily targeted at the needs of the Chinese market.

Country: China – Headquarters: Beijing – Founded: 2016

Website: landspace.com

5. Astranis

![]() Market: Satellite communication – Total funding: $353.5 Million

Market: Satellite communication – Total funding: $353.5 Million

Astranis is a manufacturer and operator of geostationary communications satellites. It develops small geostationary satellites dedicated to transmitting data down to specific terrestrial locations, notably to provide internet connectivity. Its first commercial application in 2021 is to provide internet access to under-linked areas of the US state of Alaska.

Country: USA – Headquarters: San Francisco, CA – Founded: 2015

Website: astranis.com

4. Planet

Market: Geospatial data analytics – Total funding: $373.9 Million

Market: Geospatial data analytics – Total funding: $373.9 Million

Planet Labs is an aerospace and data analytics company dedicated to Earth imaging. It develops miniature satellites equipped with telescopes and cameras programmed to capture images from Earth’s surface. Now operating more than 200 active satellites, Planet compiles its data to power a range of services including climate monitoring, crop yield prediction, urban planning, and disaster response.

Country: USA – Headquarters: San Francisco, CA – Founded: 2010

Website: planet.com

3. Relativity Space

![]() Market: Space launch – Total funding: $1.3 Billion

Market: Space launch – Total funding: $1.3 Billion

Relativity Space is a space manufacturing and transport company. It designs, develops, and builds 3D printed rockets, rocket engines, and manufacturing technologies for commercial orbital launch services. Relying upon 3D printing, artificial intelligence, and autonomous robotics, Relativity Space considerably simplifies and accelerates rocket building.

Country: USA – Headquarters: Long Beach, CA – Founded: 2015

Website: relativityspace.com

2. Blue Origin

Market: Space launch, Sub-orbital spaceflight – Total funding: $3.5 Billion

Market: Space launch, Sub-orbital spaceflight – Total funding: $3.5 Billion

Blue Origin is a space and sub-orbital manufacturing and transport company. It aims at reducing the cost to access space with reusable launch vehicles and a wide variety of technologies. Gradually expanding from suborbital to orbital flight with vehicles and rocket engines, Blue Origin now provides its “New Shepard” flight experience, the first weightless suborbital travel to more than 100km above sea level.

Country: USA – Headquarters: Kent, WA – Founded: 2000

Website: blueorigin.com

1. SpaceX

![]() Market: Space launch, Satellite communication – Total funding: $6.6 Billion

Market: Space launch, Satellite communication – Total funding: $6.6 Billion

SpaceX – Space Exploration Technologies Corporation – is a company dedicated to space transportation aiming at improving the cost and reliability of accessing space by a factor of ten. It designs, manufactures, and launches rockets and spacecraft, especially focusing on reusable launch vehicles. SpaceX has also recently launched Starlink to provide satellite internet access through a constellation of satellites.

Country: USA – Headquarters: Hawthorne, CA – Founded: 2002

Website: spacex.com

Summary: Top 10 Space Startups 2021

To give you a quick overview of the largest Space startups in the world in 2021, here is a synthesizing image regrouping the information of the top 10. Note that you can use this image to embed it on your website and other digital properties using the embed code below.

Embed code:

<a href="https://blog.disfold.com/top-space-startups/" target="_blank" rel="noopener noreferrer"><img src="https://blog.disfold.com/wp-content/uploads/2021/07/top-10-space-startups.jpg" alt="The world's Top 10 Space Startups 2021"></a>

Here are the top 30 best-funded Space startups in the world. Did we forget any? Which one is your favorite? Do you think they will be able to bring humankind to Mars? And beyond? Let us know in the comments below!

![Top 1200 UK Companies [FTSE All-Share + FTSE AIM All-Share] – Excel Download](http://store.disfold.com/wp-content/uploads/sites/11/2024/05/top-1200-uk-companies-ftseallshare-aimallshare-small.jpg)

![Top 500 Australian Companies [All Ordinaries] – Excel Download](http://store.disfold.com/wp-content/uploads/sites/11/2021/04/top-500-australian-companies-allordinaries-small.jpg)