The largest companies of the United Kingdom greatly impact the British and world economy. The UK’s top 30 publicly traded companies, major components of the FTSE index, are presented here together with their activities, logos, sectors, and useful links.

![]() In the United Kingdom, companies become publicly listed companies – PLC – to get listed on the London Stock Exchange – LSE. Though they have to follow the rules of the British Financial Conduct Authority, companies that become publicly listed on the LSE can then gain access to capital from investors who acquire their stocks.

In the United Kingdom, companies become publicly listed companies – PLC – to get listed on the London Stock Exchange – LSE. Though they have to follow the rules of the British Financial Conduct Authority, companies that become publicly listed on the LSE can then gain access to capital from investors who acquire their stocks.

Check our data platform for the latest ranking of UK companies and FTSE 100 companies, and our blog roundup for top UK companies 2023.

The FTSE 100 Index

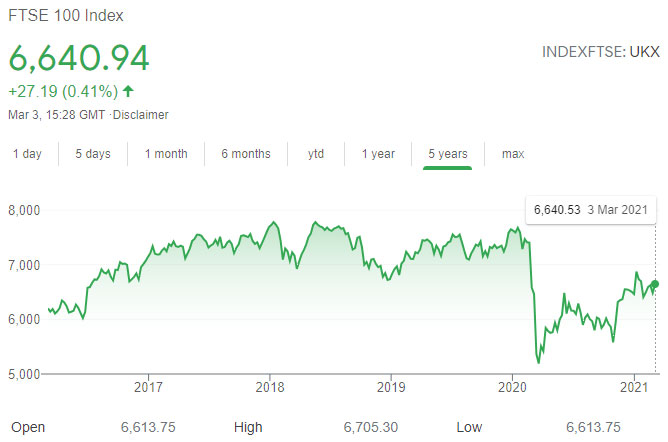

To ease the understanding of the evolution of the British stock market and the broader UK economy, the stocks of the 100 largest companies listed on the London Stock Exchange are aggregated in the FTSE 100 index. Meaning “Financial Time Stock Exchange 100”, and often more simply referred to as FTSE, the FTSE 100 index is widely recognized as the benchmark index of the British stock market.

Calculated from the stocks of the 100 largest corporations by market capitalization listed on the LSE, the FTSE is a capitalization-weighted index where larger companies are weighted more heavily in the index. It represents around 70% of the total market capitalization of the companies listed on the London Stock Exchange.

For more information on the largest British companies, download our FTSE 350 companies Excel file containing the complete list of the 350 largest publicly listed companies in the UK (FTSE 100 + FTSE 250), together with extensive business, market, financial, and digital information on each company. For even more data on the largest UK companies, download our Excel files on the FTSE All-Share companies, FTSE AIM All-Share companies, and combined FTSE All-Share companies + FTSE AIM All-Share companies.

The real-time quotation of the FTSE 100 index can be followed with convenient graphical tools from a number of sources, including the London Stock Exchange, Google Finance, Yahoo Finance, Bloomberg, etc.

For more information on other world-leading companies, check our series of posts on Top Companies, and for more information on the country, read our articles on Top Business Resources for the UK.

List of the 30 largest companies listed in the United Kingdom by market capitalization

To help you learn more about British corporations, the 30 largest companies listed on the London Stock Exchange, which are also the largest components of the FTSE 100 index, are listed hereafter. Each company is presented with details on its sector and industry, operations, a direct link to its website, market capitalization, logo, and stock symbol. The top 30 FTSE 100 companies are ranked by market capitalization in Pounds Sterling, as of effective close on Friday, February 26, 2021.

Remark that since it is not a company per se, but an investment trust, the Scottish Mortgage Investment Trust, which is among the top 30 largest market capitalizations in the FTSE 100 has been left out of this ranking.

Note that if you are searching for information on these companies to invest in their stocks, make sure you know what you are doing as your investment will be subject to significant risks with the evolution of stock prices. To learn more about investing in the stock market and managing your portfolio, check our post on the best online courses on stock investing and trading.

Shortcuts to each top British company

To facilitate your browsing in this long list, here are quick links to go directly to the details of any of the top 30 FTSE 100 companies. Be sure to also check the Top 10 UK companies’ summary after the list!

30. Tesco

![]() Sector: Consumer Defensive – Industry: Grocery Stores

Sector: Consumer Defensive – Industry: Grocery Stores

Tesco PLC is a multinational grocery and general merchandise retailer. Founded in 1919, Tesco has grown to become the world’s third-largest retailer, operating hypermarkets and convenience stores selling groceries, books, clothing, electronics, furniture, toys, petrol, software, financial services, telecoms, and internet services in seven countries.

Website: tescoplc.com – Market Cap.: £17.4 Billion – Stock ticker: TSCO

29. Ashtead Group

Sector: Industrials – Industry: Rental & Leasing Services

Sector: Industrials – Industry: Rental & Leasing Services

Ashtead Group PLC is an international equipment rental company. Operating under the trading name Sunbelt Rentals through more than 840 stores across the United States, 70 in Canada, and 180 stores across the United Kingdom, it offers a wide range of construction and industrial equipment for rent.

Website: ashtead-group.com – Market Cap.: £17.4 Billion – Stock ticker: AHT

28. Antofagasta PLC

![]() Sector: Basic Materials – Industry: Copper

Sector: Basic Materials – Industry: Copper

Antofagasta PLC is a multinational copper mining company that is also involved in transport. Primarily operating four copper mines in Chile, Antofagasta is also operating railroad transportation from Antofagasta (Chile) to Bolivia, the Twin Metals copper and nickel mining company in the US State of Minnesota, and other exploration joint ventures around the world.

Website: antofagasta.co.uk – Market Cap.: £17.6 Billion – Stock ticker: ANTO

27. Associated British Foods

Sector: Consumer Defensive – Industry: Packaged Foods

Sector: Consumer Defensive – Industry: Packaged Foods

Associated British Foods PLC is a multinational food processing and retailing company. Founded in 1935, the company has evolved to become a leader in the production of ingredients, such as sugar and baker’s yeast, grocery products with brands including Mazola, Ovaltine, Ryvita, Jordans and Twinings and retail, with spaces across Europe and the United States.

Website: abf.co.uk – Market Cap.: £18.7 Billion – Stock ticker: ABF

26. Ferguson

![]() Sector: Industrials – Industry: Industrial Distribution

Sector: Industrials – Industry: Industrial Distribution

Ferguson PLC is a building materials company. Tracing its origin to 1887, Ferguson now distributes a range of plumbing and heating products, as well as ventilation, air conditioning and refrigeration, waterworks, and industrial products. It operates in the United States, Puerto Rico, Mexico, and the Caribbean through the Ferguson brand, and in Canada and Central Europe through the Wolseley brand.

Website: fergusonplc.com – Market Cap.: £19 Billion – Stock ticker: FERG

25. Experian

![]() Sector: Industrials – Industry: Consulting Services

Sector: Industrials – Industry: Consulting Services

Experian PLC is a consumer credit reporting agency. Based in Ireland, it operates in 37 countries, where it gathers credit information on millions of consumers. Experian also sells decision analytics and marketing assistance to businesses.

Website: experianplc.com – Market Cap.: £20.9 Billion – Stock ticker: EXPN

24. NatWest Group

![]() Sector: Financials – Industry: Diversified Banks

Sector: Financials – Industry: Diversified Banks

NatWest Group, standing for National Westminster, previously known as The Royal Bank of Scotland and RBS, is a private, and partly publicly-owned, banking, and insurance holding company. Tracing its origins to 1707, NatWest Group operates in Europe, North America, and Asia through multiple brands providing personal and business banking, private banking, insurance, and corporate finance, notably NatWest, The Royal Bank of Scotland, Ulster Bank, and Coutts.

Website: natwestgroup.com – Market Cap.: £22.3 Billion – Stock ticker: NWG

23. Flutter Entertainment

![]() Sector: Consumer Cyclical – Industry: Gambling

Sector: Consumer Cyclical – Industry: Gambling

Flutter Entertainment PLC is a bookmaking holding company. Operating across four key divisions, online, retail, Australia and the United States, Flutter Entertainment operates betting shops, online sports betting, gambling and casinos websites, through a number of brands including Paddy Power, Betfair, Adjarabet, BetEasy, FanDuel, Fox Bet, Full Tilt Poker, PokerStars, Sky Bet, Sportsbet.com.au, Timeform and TVG Network.

Website: flutter.com – Market Cap.: £24.1 Billion – Stock ticker: FLTR

22. CRH

Sector: Basic Materials – Industry: Building Materials

Sector: Basic Materials – Industry: Building Materials

CRH PLC is an international group of diversified building materials. It produces and supplies a wide range of products for the construction industry, including heavy side materials, such as aggregates, cement, asphalt, concrete, and light side products, such as glass and glazing products, shutters, and accessories. It is also involved in the distribution of these products.

Website: crh.com – Market Cap.: £24.3 Billion – Stock ticker: CRH

21. Compass Group

Sector: Consumer Cyclical – Industry: Restaurants

Sector: Consumer Cyclical – Industry: Restaurants

Compass Group PLC is a multinational contract foodservice company. The largest contract foodservice company in the world, providing food and support services in more than 50 countries across five market sectors: business and industry, healthcare and seniors, education, sports and leisure, defense, offshore and remote.

Website: compass-group.com – Market Cap.: £26 Billion – Stock ticker: CPG

20. Lloyds Banking Group

Sector: Financials – Industry: Regional Banks

Sector: Financials – Industry: Regional Banks

Lloyds Bank PLC is a retail and commercial bank. Evolved from the Bank of Scotland founded in 1695, Lloyds Banking Group has developed its activities primarily in England and Wales in retail banking, commercial banking, life, pensions and insurance, wealth management, and international operations in the U.S., Europe, the Middle East, and Asia.

Website: lloydsbankinggroup.com – Market Cap.: £27.6 Billion – Stock ticker: LLOY

19. Barclays

Sector: Financials – Industry: Diversified Banks

Sector: Financials – Industry: Diversified Banks

Barclays PLC is a British investment bank and financial services company. Tracing its origin to 1690, Barclays is primarily involved in investment banking with additional services in personal banking, corporate banking, wealth management, and investment management.

Website: home.barclays – Market Cap.: £27.7 Billion – Stock ticker: BARC

18. National Grid

Sector: Utilities – Industry: Diversified Utilities

![]() National Grid PLC is a multinational electricity and gas utility company. It primarily operates in electricity transmission and gas distribution in the United Kingdom and the United States, managing operations directly or through subsidiary companies.

National Grid PLC is a multinational electricity and gas utility company. It primarily operates in electricity transmission and gas distribution in the United Kingdom and the United States, managing operations directly or through subsidiary companies.

Website: nationalgridet.com – Market Cap.: £28.6 Billion – Stock ticker: NG.

17. RELX Group

![]() Sector: Communication Services – Industry: Publishing

Sector: Communication Services – Industry: Publishing

RELX PLC, also known as RELX Group, is a multinational information and analytics company. RELX Group is engaged in four business segments: scientific, technical, and medical, under the Elsevier brand, risk, and business analytics, under the LexisNexis Risk Solutions and Reed Business Information brands, legal, under the LexisNexis brand, and exhibitions, under the Reed Exhibitions brand.

Website: relx.com – Market Cap.: £32.7 Billion – Stock ticker: REL

16. Vodafone

Sector: Communication Services – Industry: Telecom Services

Sector: Communication Services – Industry: Telecom Services

Vodafone Group plc is a multinational telecommunications company. Engaged predominantly in mobile connectivity services, Vodafone also provides broadband, television, and enterprise services such as voice, cloud services as well as Internet-of-Things services for a number of applications in industries including automotive, insurance, and healthcare. A leader in the UK, Vodafone also operates directly or indirectly in more than 150 countries.

Website: vodafone.com – Market Cap.: £32.7 Billion – Stock ticker: VOD

15. Prudential

Sector: Financials – Industry: Life Insurance

Sector: Financials – Industry: Life Insurance

Prudential PLC is a multinational life insurance and financial services company. Founded in 1848, it has grown become a leading insurance and asset management provider in Asia with Prudential Corporation Asia, one of the largest life insurance providers in the United States with Jackson National Life Insurance Company, and a leading savings and investments business in the UK and Europe with M&G Prudential.

Website: prudentialplc.com – Market Cap.: £36.8 Billion – Stock ticker: PRU

14. Anglo American

![]() Sector: Basic Materials – Industry: Industrial Metals & Mining

Sector: Basic Materials – Industry: Industrial Metals & Mining

Anglo American PLC is a mining company based in South Africa and the United Kingdom. Founded in 1917, Anglo American is the world’s largest producer of platinum, and a major producer of diamonds, copper, nickel, iron ore, and metallurgical and thermal coal.

Website: angloamerican.com – Market Cap.: £37.8 Billion – Stock ticker: AAL

13. Glencore

![]() Sector: Basic Materials – Industry: Industrial Metals & Mining

Sector: Basic Materials – Industry: Industrial Metals & Mining

Glencore PLC is an Anglo-Swiss multinational commodity trading and mining company. Glencore is operating mining and metallurgical sites, oil production assets, agricultural facilities, and it is engaged in the sourcing and distribution of its commodities throughout the world.

Website: glencore.com – Market Cap.: £38.7 Billion – Stock ticker: GLEN

12. Reckitt Benckiser

Sector: Consumer Defensive – Industry: Household & Personal Products

Sector: Consumer Defensive – Industry: Household & Personal Products

Reckitt Benckiser Group PLC, also known as RB, is a multinational consumer goods company, producing health, hygiene and home products. Tracing its origins back to the 19th century, RB has grown to a global company with famous brand names including Dettol, Strepsils, Veet, Airborne, Gaviscon, Mead Johnson, Air Wick, Calgon, Clearasil, Cillit Bang, Durex, Lysol, Mycil and Vanish.

Website: rb.com – Market Cap.: £42.8 Billion – Stock ticker: RB.

11. London Stock Exchange Group

![]() Sector: Financials – Industry: Financial Data & Stock Exchanges

Sector: Financials – Industry: Financial Data & Stock Exchanges

The London Stock Exchange Group is a stock exchange and financial information company. Founded in 1801, it operates the main stock exchange of the United Kingdom, and the Italian stock exchange, Borsa Italiana. It is also involved in information technology through LSEG Technology, financial market data, and infrastructure through Refinitiv, owns the FTSE Russell market indices company, and has majority stakes in the clearinghouse LCH and Tradeweb financial services.

Website: lseg.com – Market Cap.: £44.6 Billion – Stock ticker: LSEG

10. British American Tobacco

Sector: Consumer Defensive – Industry: Tobacco

Sector: Consumer Defensive – Industry: Tobacco

British American Tobacco PLC, also known as BAT, is a multinational cigarette and tobacco manufacturing company. Formed in 1902, BAT is now the world’s second-largest tobacco producer with multiple international brands such as Lucky Strike, Dunhill, Pall Mall, Rothmans International, Winfield, and a large array of local brands.

Website: bat.com – Market Cap.: £57 Billion – Stock ticker: BATS

9. BP

Sector: Energy – Industry: Oil & Gas Integrated

Sector: Energy – Industry: Oil & Gas Integrated

BP PLC, formerly The British Petroleum Company and BP Amoco, is a multinational oil and gas company. Founded in 1909, BP operates in oil and gas through exploration and production, refining, distribution and marketing, petrochemicals, power generation, and trading, and also has interests in renewable energy with biofuels and wind power.

Website: bp.com – Market Cap.: £59.4 Billion – Stock ticker: BP.

8. GlaxoSmithKline

Sector: Healthcare – Industry: Pharmaceuticals

Sector: Healthcare – Industry: Pharmaceuticals

GlaxoSmithKline PLC, better known as GSK, is a pharmaceutical company. GSK manufactures products for major disease areas such as asthma, cancer, infections, diabetes, and mental health, and it also has a portfolio of vaccines. Operating in more than 115 countries, GSK is also engaged in the consumer healthcare business in oral health, pain relief, respiratory, nutrition/gastro-intestinal, and skin health categories.

Website: gsk.com – Market Cap.: £59.9 Billion – Stock ticker: GSK

7. Diageo

Sector: Consumer Defensive – Industry: Wineries & Distilleries

Sector: Consumer Defensive – Industry: Wineries & Distilleries

Diageo PLC is a multinational alcoholic beverages company. Notably the world’s largest producer of whiskey, Diageo is involved in the production and distribution of multiple spirits and beers, with some of the world’s most famous brands including Guinness, Johnnie Walker, Smirnoff, and Gordon’s.

Website: diageo.com – Market Cap.: £65.8 Billion – Stock ticker: DGE

6. HSBC

![]() Sector: Financials – Industry: Diversified Banks

Sector: Financials – Industry: Diversified Banks

HSBC Holdings PLC is a multinational banking and financial services company, dual-listed both in London and Hong Kong. Founded in Hong Kong and Shanghai in 1865, HSBC has grown to operate in more than 60 countries, with operations in commercial banking, investment banking, retail banking and wealth management, and global private banking.

Website: hsbc.com – Market Cap.: £86.8 Billion – Stock ticker: HSBA

5. AstraZeneca

Sector: Healthcare – Industry: Pharmaceuticals

Sector: Healthcare – Industry: Pharmaceuticals

AstraZeneca PLC is an Anglo–Swedish multinational pharmaceutical and biopharmaceutical company. AstraZeneca develops, manufactures, and sells pharmaceuticals and biotechnology products to treat major disease areas including cancer, cardiovascular, gastrointestinal, infection, neuroscience, respiratory, and inflammation.

Website: astrazeneca.com – Market Cap.: £91.2 Billion – Stock ticker: AZN

4. Rio Tinto

Sector: Basic Materials – Industry: Industrial Metals & Mining

Sector: Basic Materials – Industry: Industrial Metals & Mining

Rio Tinto PLC is the British part of the Anglo-Australian multinational metals and mining corporation that is also listed on the Australian Stock Exchange and a top constituent of the ASX index. Founded in 1873, Rio Tinto has evolved to become a leader in the extraction of minerals, especially aluminum, iron ore, copper, uranium, and diamonds, and developed operations in refining, particularly for bauxite and iron ore. With a global presence, Rio Tinto is primarily operating in Australia and Canada.

Website: riotinto.com – Market Cap.: £100.1 Billion – Stock ticker: RIO

3. Royal Dutch Shell

Sector: Energy – Industry: Oil & Gas Integrated

Sector: Energy – Industry: Oil & Gas Integrated

Royal Dutch Shell PLC, simply known as Shell, is a British-Dutch oil and gas company. Founded in 1907, headquartered in the Netherlands, and incorporated in the UK, Shell is now present in more than 70 countries. It operates in oil and gas in exploration and production, refining, transport, distribution and marketing, petrochemicals, power generation, and trading, and is also engaged in renewable energies with biofuels, wind, and hydrogen.

Website: shell.com – Market Cap.: £111 Billion – Stock ticker: RDSA / RDSB

2. BHP

Sector: Basic Materials – Industry: Industrial Metals & Mining

Sector: Basic Materials – Industry: Industrial Metals & Mining

BHP Group PLC is the British arm of the Anglo-Australian multinational mining, metals, and petroleum corporation that is also listed on the Australian Stock Exchange and a top constituent of the ASX index. BHP is involved in the exploration, production, and processing of minerals, especially coal, iron ore, copper, and manganese ore, and the exploration, production, and refining of hydrocarbons.

Website: bhp.com – Market Cap.: £114.8 Billion – Stock ticker: BHP

1. Unilever

Sector: Consumer Defensive – Industry: Household & Personal Products

Sector: Consumer Defensive – Industry: Household & Personal Products

Unilever is a British-Dutch multinational consumer goods company dual-listed in the United Kingdom and the Netherlands. Formed from companies founded in the 1870s, Unilever now regroups more than 400 brands, including Axe/Lynx, Dove, Omo, Heartbrand ice creams, Hellmann’s, Knorr, Lipton, Lux, Magnum, Rexona/Degree, Sunsilk, and Surf.

Website: unilever.com – Market Cap.: £152.4 Billion – Stock ticker: ULVR

Summary: Top 10 companies in the FTSE 2021

To give you a quick review of the largest companies in the FTSE 100 index in 2021, here are the top 10 FTSE 100 companies by market capitalization as of February 26, 2021.

- Unilever – £152.4 Billion

- BHP – £114.8 Billion

- Royal Dutch Shell – £111 Billion

- Rio Tinto – £100.1 Billion

- AstraZeneca – £91.2 Billion

- HSBC – £86.8 Billion

- Diageo – £65.8 Billion

- GlaxoSmithKline – £59.9 Billion

- BP – £59.4 Billion

- British American Tobacco – £57 Billion

You will also find the top 10 in this synthesizing image that also regroups the information of each FTSE 100 company with its industry. Remark that you can use this image to embed it on your website and other digital properties using the embed code below.

Embed code:

<a href="https://blog.disfold.com/top-companies-uk-ftse/" target="_blank" rel="noopener noreferrer"><img src="https://blog.disfold.com/wp-content/uploads/2021/03/top-10-companies-ftse.jpg" alt="Top 10 companies in the FTSE 2021"></a>

Here are the top 30 FTSE 100 companies. Do you think they are worth their market capitalization? Are their stocks a good investment right now? Do they have too much economic power… and maybe political power too?

Leave your comments below!

![Top 1200 UK Companies [FTSE All-Share + FTSE AIM All-Share] – Excel Download](http://store.disfold.com/wp-content/uploads/sites/11/2024/05/top-1200-uk-companies-ftseallshare-aimallshare-small.jpg)

![Top 500 Australian Companies [All Ordinaries] – Excel Download](http://store.disfold.com/wp-content/uploads/sites/11/2021/04/top-500-australian-companies-allordinaries-small.jpg)

Thank god you left Philip, the last thing the U.K. needs are ignorant negative people such as yourself. I unfortunately read what you wrote and all I could think of was, this guy just lives in a world full of assumptions.

4 paragraphs of illiterate nonsense, thank you for wasting 2 minutes of my life.

Phillip Hughes, spot on. 12 years ago I advised my daughter to leave this country as I considered it was doomed by Class, Conservatism and Apathy. She took my advice and has been living and working in New Zealand for 11 years. She has a better lifestyle and better pay now. The doom I foresaw for this country is accelerating: the rich are richer, the poor poorer. Apathy has lead to Brexit which will finish off this country completely.

Why so much disgrace? The ups and downs are very normal in business. And the companies that have dropped from rank still have opportunities to be back up.

Thank you for the updated list.